News outlets have been pounding FedEx, UPS and USPS for shipping delays during COVID and sharing the news of costly rate surcharges, which are becoming a real problem for retailer margins. But they are missing out on what might be an even bigger part of the story – at least when it comes to the actual delivery results for consumers. Total time from a shopper spending cold hard cash to buy something online until it gets delivered has gone up even more dramatically. The problem goes beyond a congested carrier network. Fulfillment times are killing most retailers and seem to be getting worse.

That’s why we’re exposing a new metric, “Click-to-Delivery” (C2D), in Convey’s Network Pulse Dashboard (check the real-time data for free here). What is C2D? The time it takes from a consumer placing an order until it safely arrives at her doorstep. Convey ingests data on millions of orders and shipments to marry fulfillment time and transit time yielding a combined C2D duration.

While each metric has standalone value – to optimize that part of the delivery – taken as a whole, we get more valuable insight aligned to the way the consumer thinks about her order. For that reason, Convey is not just exposing this data, but moving towards the concept of unified order visibility that will contemplate all the legs of a last mile journey, enabling retailers to optimize performance in a way that best meets consumer expectations.

Why should retailers benchmark Click-to-Delivery?

Consumers don’t care about arbitrary dates like ‘ships in 5 days’ or carrier SLAs like ‘ground shipping in 3-5 days’. What they want to know is, “When will my package arrive?” If it’s urgent, like flowers for Mother’s Day or a new grill for Labor Day, all a shopper wants to know is whether it will arrive on time. Today, most retailers have a bit of (often disparate) data about their own fulfillment and (even less accurate) data about transit times. They really don’t know how competing brands are doing – which is the yardstick that consumers use to compare. Brands must put themselves in their shoppers’ shoes and contemplate how their entire last mile operation contributes to an exceptional experience from click … to delivery.

Armed with strong data around C2D, retail supply chain leaders can make better-informed decisions about when and where to add new distribution centers, partners or channels. They can also get a better understanding of when to lean in with carrier partners, drop-ship vendors or internal teams to improve customer outcomes. These two parts of the operation must work in concert – else we are simply looking at one half of the story.

What are the current Click-to-Delivery trends?

No one should be surprised to see that the trends expose the many struggles in getting orders to consumer doors in a timely fashion.

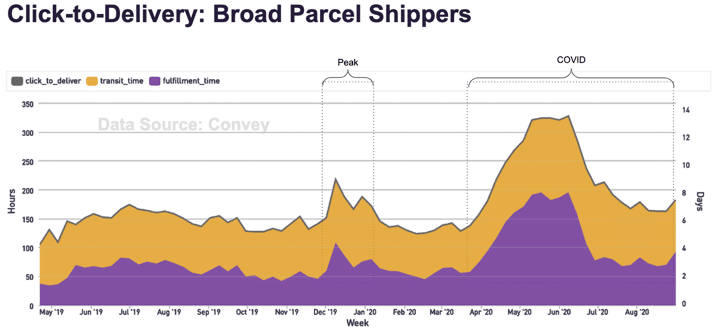

Parcel Click-to-Delivery Trends

When we look across our entire array of parcel shippers over the course of the last year, it’s clear that the relatively small spike in C2D times that we see at holiday has been dwarfed by the delays during this pandemic. With inventory issues, staffing challenges and carrier shortages all stacking up, it’s not surprising that consumers are starting to get irritated with unreliable deliveries. During the last few months, the fulfillment time for parcel deliveries has been impacted more than transit time, suggesting that inventory and warehousing bottlenecks are harder to bounce back from than transportation issues. In fact, it appears that we’ve recently landed at a ‘new normal’ that is roughly 1-3 days slower than averages pre-pandemic.

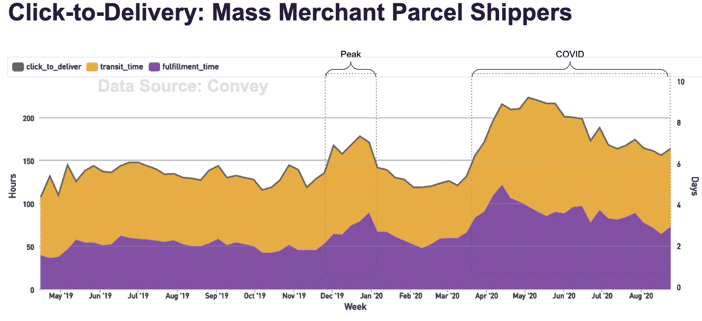

Mass Merchant Click-to-Delivery Trends

Drilling in a bit more, we find that Mass Merchants have a ‘smoother’ curve. This data set excludes apparel, specialty, food and other singular categories and is limited to a set of larger retailers who sell a variety of merchandise. While these retailers are also experiencing delays across the board, the spikes are less pronounced indicating that they are better at managing both inventory and carrier partnerships. This could stem from a combination of factors such as their diversity of merchandise, myriad shipment methods (direct, ship-from-store, dropship, etc), larger budgets for inventory on hand and more influence through strong carrier contracts.

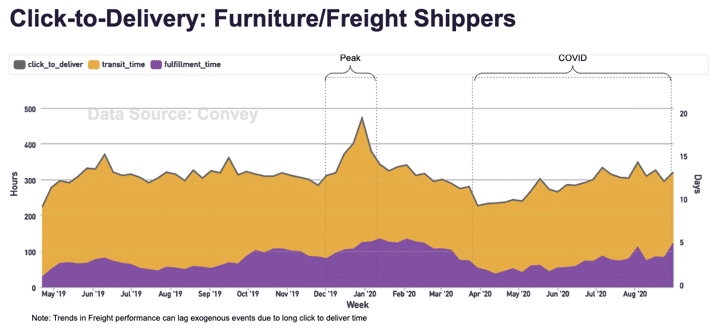

Furniture Click-to-Delivery Trends

The last merchandise category we want to explore – because the results are so different – is the freight-heavy furniture industry. What jumps out here is that there is only a tiny spike during peak holiday season which makes sense since furniture is rarely a gift and that small peak is likely more about a new table for the Thanksgiving turkey. As we look at COVID-era shipping, there is a slow but steady incline in both fulfillment and transit time. Since many of these products typically have long lead times, furniture retailers likely already had product en route for order expected in a few weeks or months. Meantime, transit times are going up at a slightly higher rate as more consumers use ecommerce for this category than ever before. We project that the C2D times in furniture will start to hit their peaks in the coming months and are offset from other spikes due to that long lead nature. It will be interesting to watch – and to partner with clients to avoid issues as much as possible.

How can you get better visibility into your Click-to-Delivery performance?

There are a few ways to get smarter about C2D and they range in sophistication and utility. The two most common are:

- DIY Analysis: Getting the basics about your own performance is something that can be done if you have a relatively straightforward distribution and carrier network. You’ll need to use your OMS to source key fulfillment data. Then you’ll need to build connections to all your carriers to ingest and then normalize their data. Marry those two data sets and you should be able to get an initial picture of your C2D times. What will be tough in this approach is maintaining real-time views as well as working to understand how you compare to others since this method is limited to your own data set.

- Partner for Richer Data: Retailers with a complex network of distribution centers, fulfillment methods (direct + dropship + ship from store), and carriers, find it faster and more fruitful to partner for C2D analysis. In order to get access to benchmarks from a cohort of similar retailers, partnership is necessary to get access to anonymized, blind data that will allow you to understand how your teams are performing. Convey has unique data across an array of omnichannel and D2C retailers to enable this type of visibility and benchmarking (and we might be able to get it done for your brand by peak 2020).

Want to learn more about Click-to-Delivery or get a personalized dive into Convey’s Network Pulse Dashboard? Start by checking out real-time metrics at the Convey Network Pulse today and sign up for our monthly data newsletter.