China expanded Covid testing this week to almost all of Beijing’s 22 million residents after new locally transmitted cases were reported, stoking concerns of an imminent lockdown like Shanghai’s.

Following the announcement, the Chinese stock market index (CSI) fell to its lowest level since May 2020, and stock markets across Asia reacted negatively to the news while global stocks fell sharply. More lockdowns would mean disruptions to global supply chains for months to come, as well as adding to already high inflationary pressures.

Where are the bottlenecks?

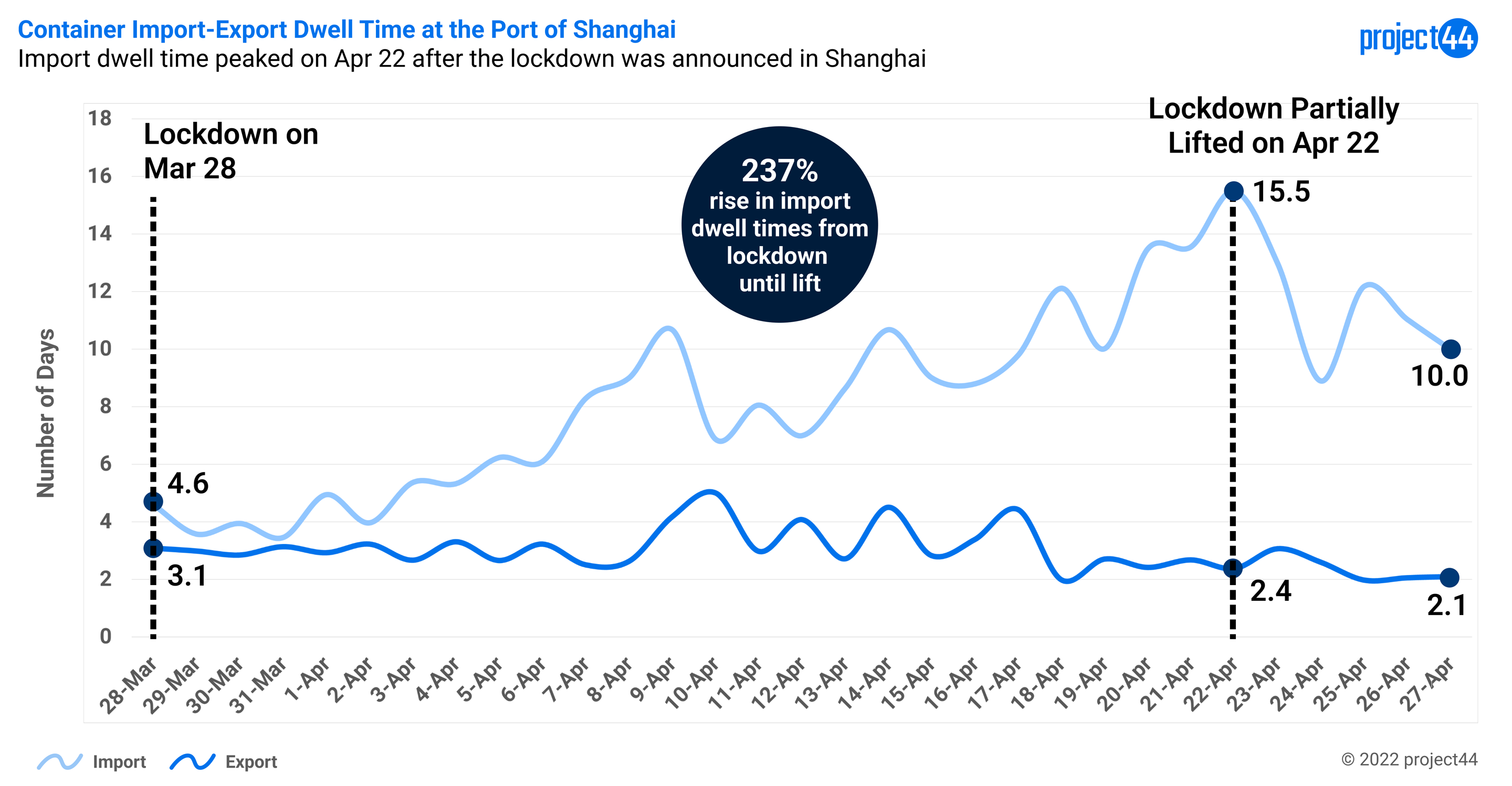

The term “congestion” can mean many things, especially after all the vessel congestion we saw in Southern California in 2021. Since China is primarily an exporter, the bottlenecks happen well before containers get to the Port of Shanghai. With the manufacturing industry being shuttered and truckers unable to travel quickly, exports have been reduced, and shipment delays have increased. Because the Port of Shanghai has been fully operable, we haven’t seen any significant rise in export container dwell times for the containers that do make it to the port.

Meanwhile, the opposite is true for import containers – their dwell time climbed 237% from 4.6 days on the first day of the lockdown to more than two weeks just before the lockdown was partially lifted on April 22. Import container delays skyrocketed because those same truckers could not pick up those arrivals from the port on time.

Moreover, breakbulk carriers moving critical raw materials for manufacturing, such as iron or copper ore, have been delayed in and around China. Shortages of these critical raw materials are having a domino effect on prices in the construction and steel industries, among many others.

Where do we see shipment delays?

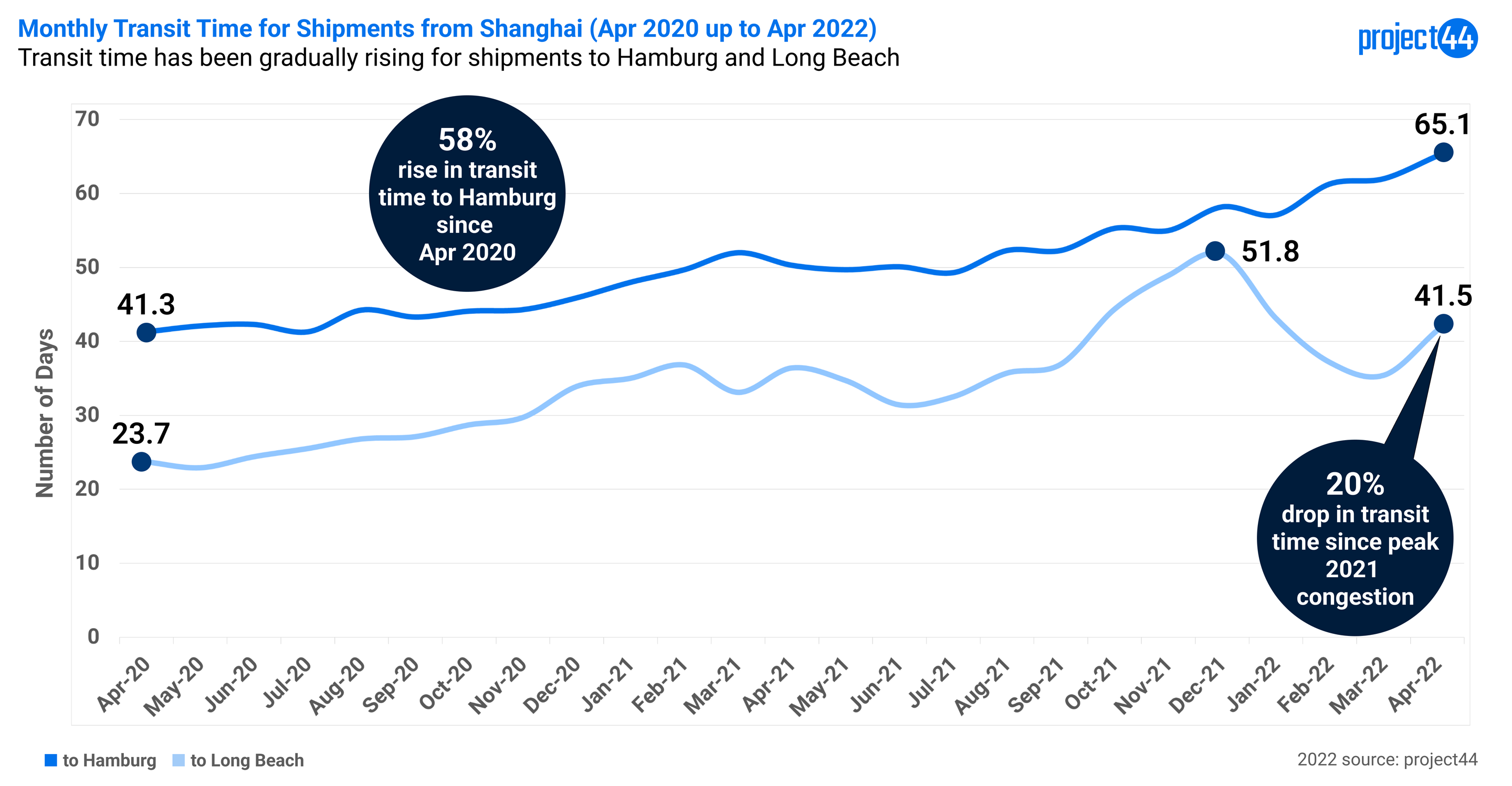

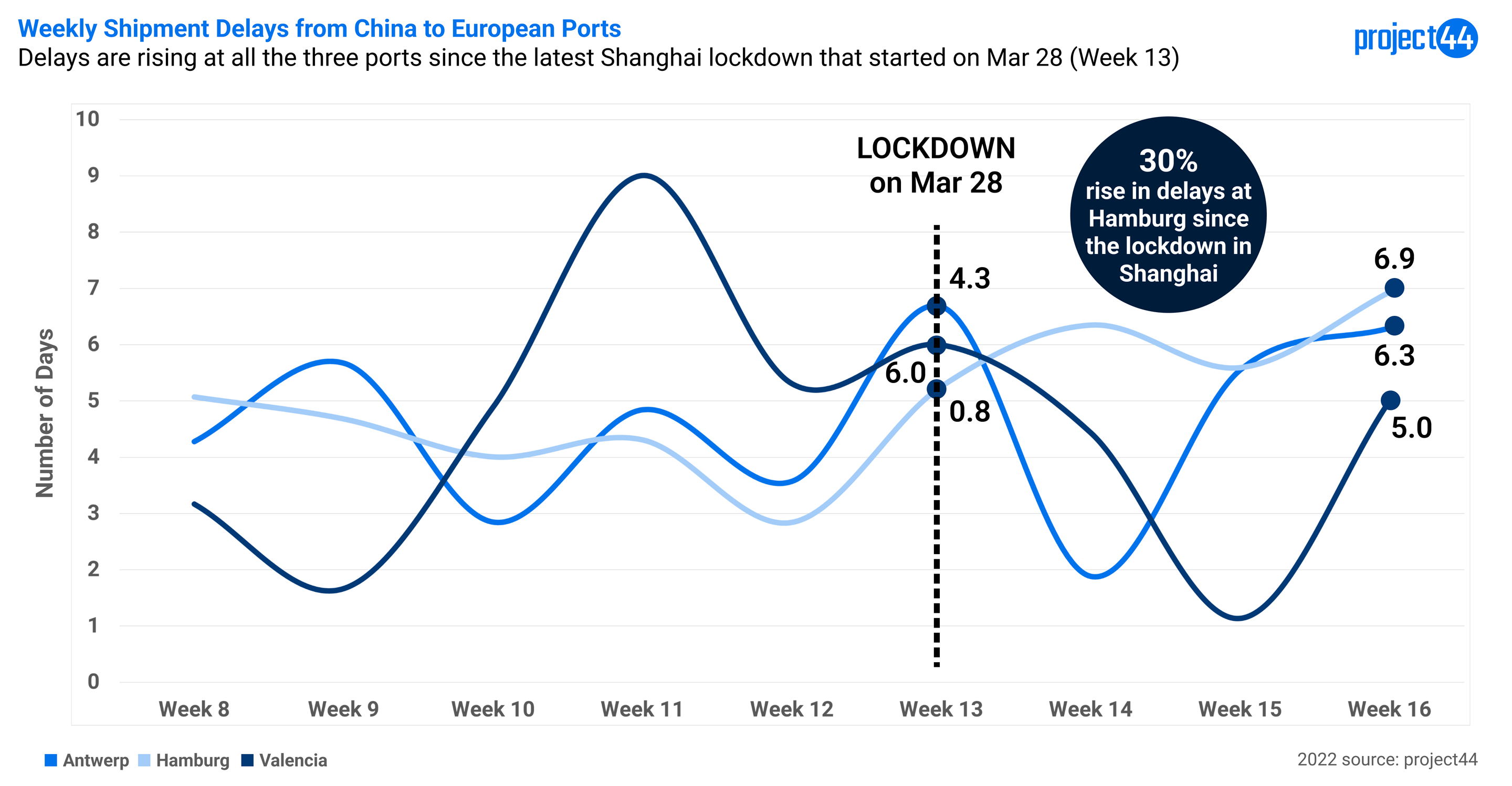

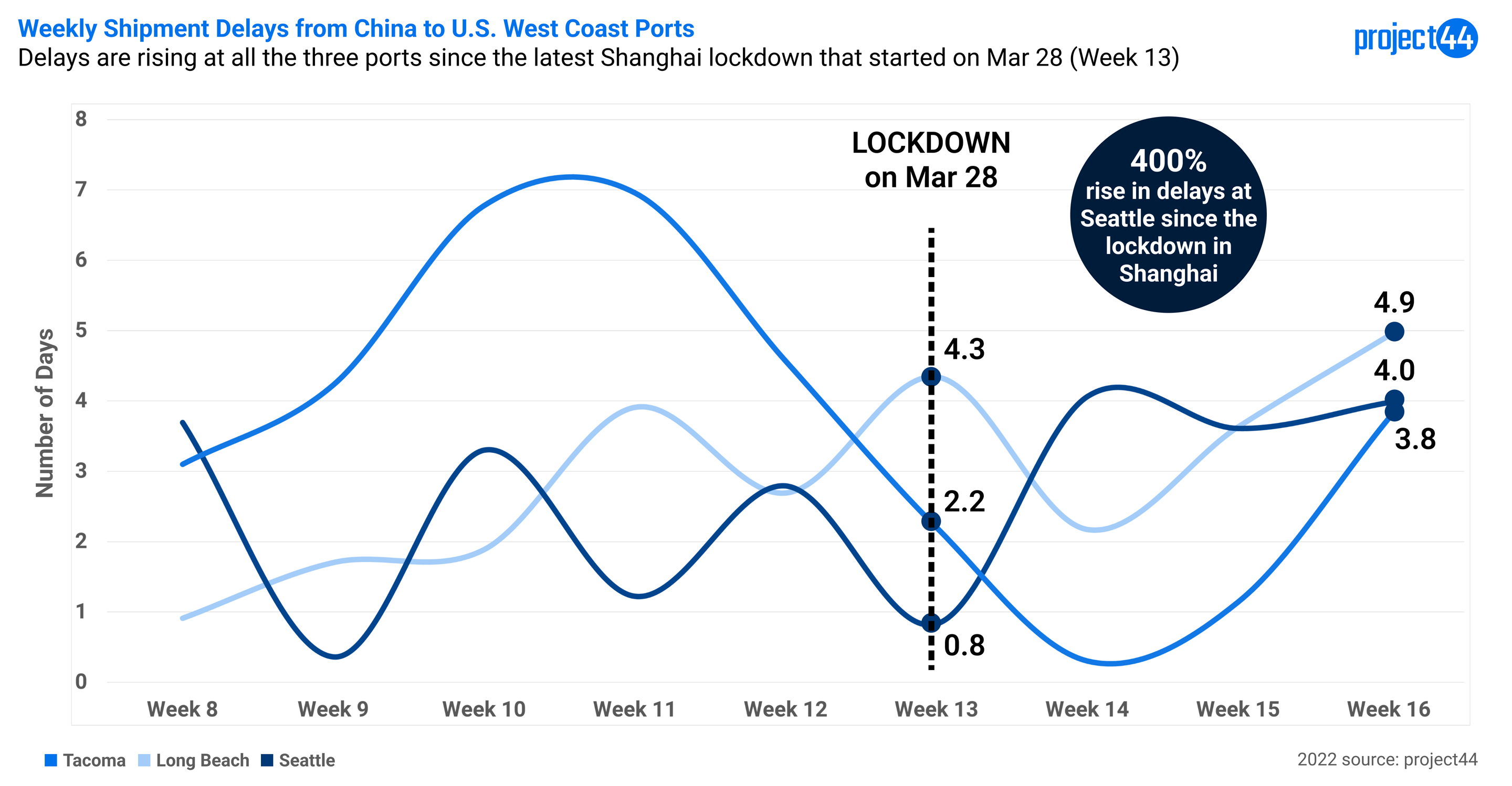

Ocean transit times, or the actual time of departure at a port of loading to the actual time of arrival at a port of discharge, between China and important ports of call have been rising continually over the last year. The ripples in shipment delays are only beginning to become visible and are expected to extend well into the next few months.

Data from project44 reveals shipment delays into major European ports of Antwerp, Hamburg, and Valencia and U.S. West Coast ports of Long Beach, Tacoma, and Seattle, are increasing. However, with increased average transit times having reached 65 days to Hamburg and more than 41 days to Long Beach, shipment delays from Shanghai will become more evident in the weeks ahead. project44 defines shipment delays as the difference between the shipment’s initial Estimated Time of Arrival (ETA) and the Actual Time of Arrival (ATA).

Reopening issues

Although authorities have allowed some business entities in Shanghai to “go back to normal operations”, many workers are still stuck in quarantine at home. As a result, factories don’t have enough staff for normal operations. Moreover, manufacturers trying to reopen factories after Covid lockdowns face component shortages and logistics issues. According to the Wall Street Journal, the Tesla display supplier AU Optronics Corp. forecasts the impact on supply chains will last for another three months, even if Chinese lockdowns end soon.

Outlook: Surge expected?

According to Pacific Maritime Association President James McKenna, the U.S. should brace for another surge in imports and supply chain delays once manufacturers in Asia reopen their factories. West Coast ports are already at peak volumes despite the lull created by Chinese lockdowns. As Mckenna adds, “by no stretch of the imagination do we think (the supply chain crunch) is over. In fact, we’re planning this to go for the entire year. There’s a lot of backlog still waiting to get out of China.” Two years of record spending have pushed these West Coast ports to the limit, with repeated delays and congestion. “The reality of the situation,” McKenna explains, “is that we’re just overwhelmed with cargo.” He cites problems along the entire logistics chain, from trucking to warehousing. These infrastructure problems may lead to new bottlenecks, especially if West Coast labor disputes throw another wrench into the supply chain this summer.

If you have any questions or comments, please get in touch with:-

Josh Brazil, Director, Supply Chain Data Insights

jbrazil@project44.com

Disclaimer: The information conveyed herein, shared solely for summary and not contractual purposes, comes from both project44 and third-party reporting. The project44 data does not include all available market information, and project44 has not undertaken to independently verify the third-party reporting. Similarly, this type of data changes from day-to-day. Accordingly, the reader should not rely on this reporting to make any business decisions, and project44 expressly disavows any liability arising from any such reliance.