Each month project44 publishes a State of Global Container Shipping Market report to keep our customers and market up to date on the latest news in ocean shipping. Particularly, as we come out of a busy summer and head into peak season, we wanted to highlight a few trends to consider.

Key Takeaways from September 2022:

- Decline in global demand will impact supply chains as we head into Q4

- Sport market rates are in free fall across the main Transpacific trade lane

- Strikes and potential strikes across the UK, EU and US put container operations under pressure

You can keep reading for more insights or view the full report here.

Increase in Vessel Berth Times

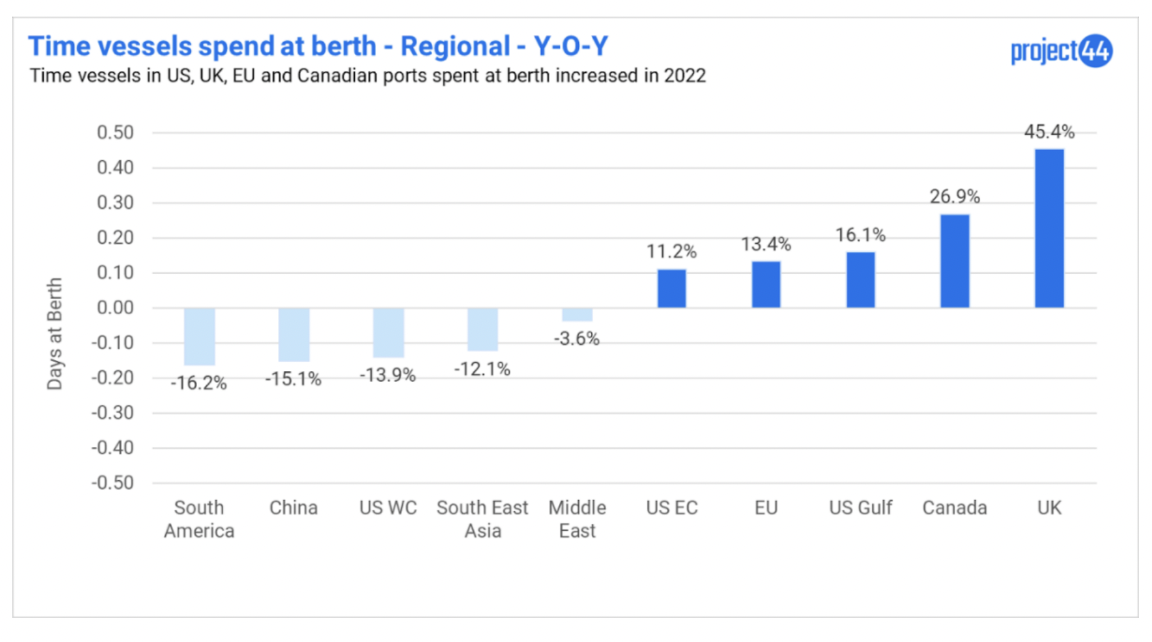

Vessel berth times give a good indication of any issues at the port. Problems including labor shortages or space constraints can add up to create increased time at berth. In the US, congestion has been the main constraint, with ports near capacity. The East Coast saw a 11.2% year-over-year increase in August 2022, the Gulf Coast recorded a 16.1% increase, while the West Coast showed a 13.9% improvement in berth times over the same period.

More drastic increases in wait times were seen in the UK, resulting from the eight-day labor strike at the port of Felixstowe.

Port Congestion

Despite increases in berth wait times, port congestion is decreasing overall. While the UK registered a 20% increase from July to August, congestion is still 66% lower than it was a year ago. Europe and the West Coast of the saw an astonishing 83% and 90% fall in port congestion year-over-year, respectively. While the East and Gulf coasts of the US were the only major regions to see both yearly and monthly increases in congestion, 120% and 223%, respectively.

Some of this congestion is owed to empty containers choking up available terminal space. While container lines prioritized the movement of empties from the US to China in 2021, the second half of this year has seen a drop in demand amid rising inflation in the US.

Shipment and Transit Delays

Carriers have improved shipment delays across most trade lanes since the start of this year. For example, the trans-Atlantic trade lane has seen average delays go from a peak of 16 days in February 2022 to around six days in August of this year.

Shipment delays have seen drastic improvement across the trans-Pacific and Asia-Europe trade lanes, especially year-over-year – falling by 29.84% and 26.68%, respectively. Asia-Europe saw a 2.87% increase in delays in August compared to July.

By contrast, only the Trans-Atlantic trade lane, albeit slight, has seen a rise in shipment delays year-over-year and month-over-month.

What to Expect

COVID concerns continue to flare in China, impacting production. And Golden Week will also close industries across the country in October, greatly impacting manufacturing output.

While a rail strike was avoided in the US in September, delays continue due to long-term labor and capacity issues. And in Europe, Felixstowe and Liverpool port workers in the UK may initiate another strike while the European mainland continues to suffer from widespread trucker strikes and port worker discontent.