For retail logistics leaders, network design is a daunting task that can help or hurt your company’s budget and customer experience. Before the carrier selection process begins, you have to collect information about your product, customer needs, and budget in order to create the best experience for customers, products, and teams.

Even as this process narrows down the search, retailers still have a long list of both national and regional carriers to choose from. As leaders map out their freight and parcel networks — and the complexities that come with them — we’ve found that many feel hesitant to diversify their carrier mix, and add regional carriers.

In this post, we will dive into two carrier diversification myths, and uncover the truth about why it might help logistics teams tackle concerns over speed, cost, and customer experience.

Carrier Diversification Myths

Myth #1: Regional carriers are more untrustworthy than national carriers such as UPS and FedEX when it comes to fulfillment. Service levels and customer service are worse when working with regional carriers.

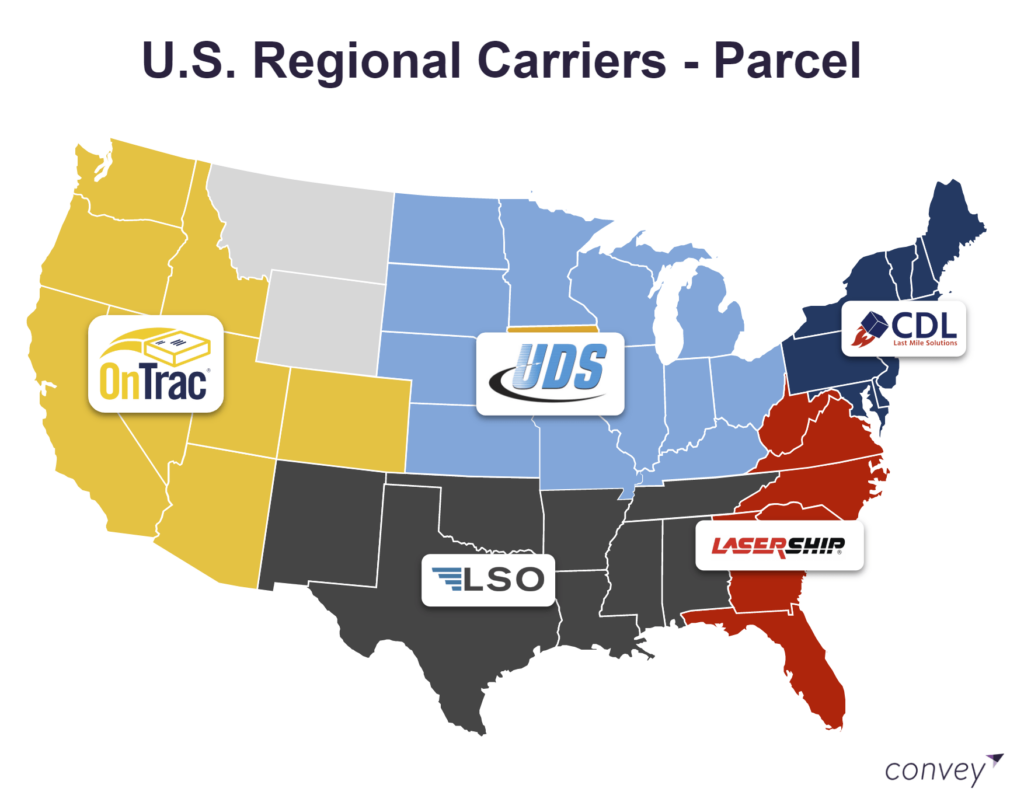

While national carriers have name recognition and larger volume, regional carriers such as UDS and OnTrac have smaller density and operating exposure, and therefore have less room for error.

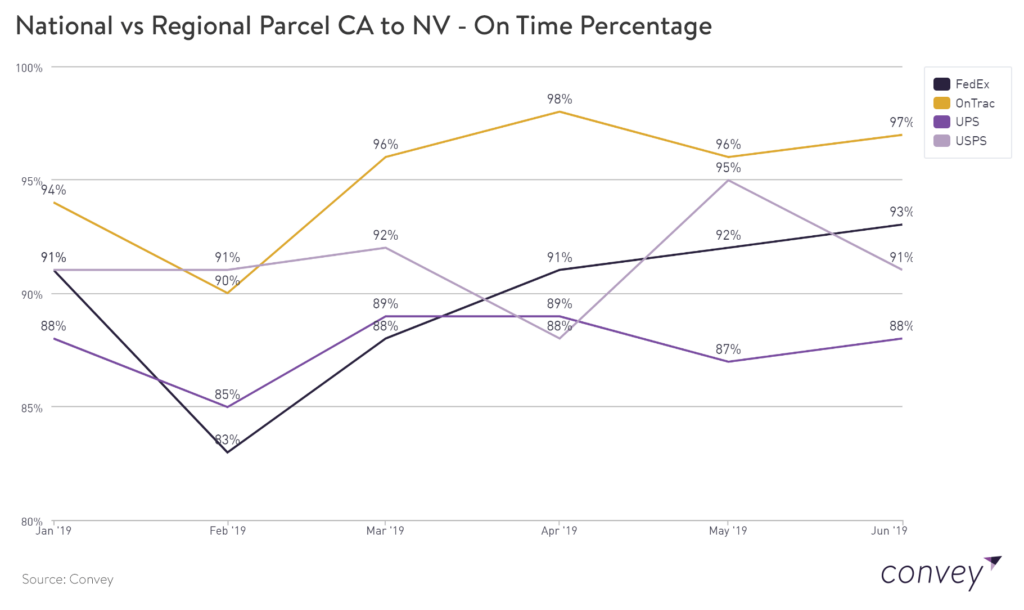

Because these regional carriers are bound by a geographic region, speed is on their side when it comes to fulfillment. With a regional focus, they can sort and send shipments faster, focusing on getting items to every destination — urban or rural — on-time and in full (OTIF) and without significant delay. For example, according to Convey data, OnTrac has performed at an almost consistently higher rate than its national counterparts shipping from California to Nevada in the the first six months of 2019.

Myth #2: You can get a better deal by giving more delivery volume to less carriers.

Just because you offer high volume to your carrier doesn’t mean that you will get more value. If delivery volume is greater than capacity, it may be more expensive to run shipments in that particular corridor, especially because carriers do not want to have to reposition their trucks at the origin or destination.

As a general rule, if your team is shipping more than $10,000 each month in freight volume or $15,000 each month in parcel volume, it is worth at least going through the exercise to understand if you can get lower rates with your carriers by leveraging account specific pricing, or if you can add on new carriers to get better deals.

The Truth About Carrier Diversification

A strong network strategy and a diversified carrier mix can help any team lessen overall transportation costs, increase delivery speeds, and protect your brand from major spikes that may affect your team.

Regional carriers can achieve faster delivery times in their respective regions at a lower cost, giving your customers better customer service.

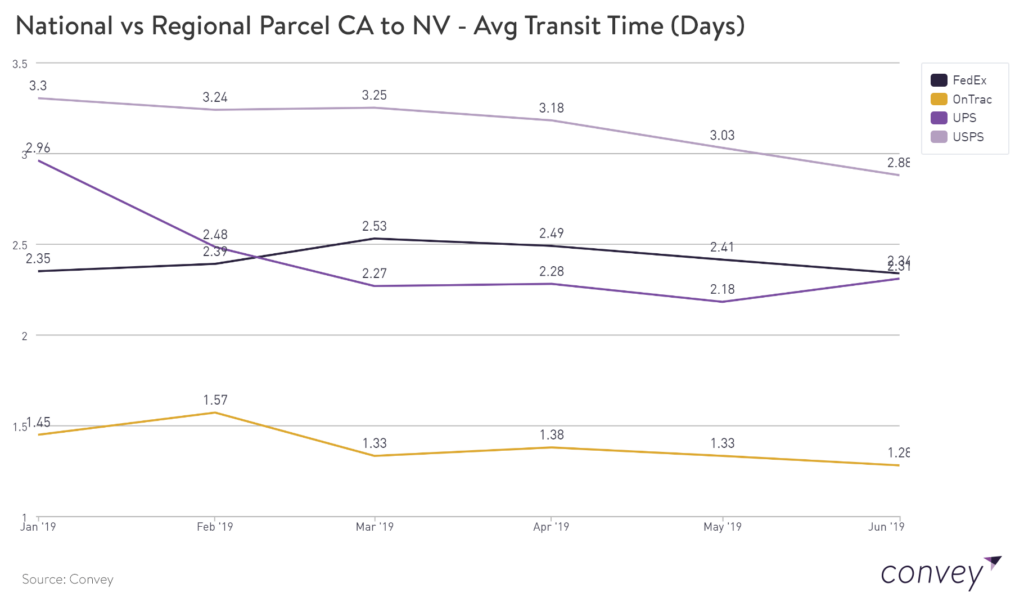

Specialized providers have core competencies in their regions, and as mentioned above, they run in remote areas more often due to geographic density. This means that they can achieve faster transit days, fulfilling next-day delivery and two-day delivery at a lower costs for parcel shipments. Meanwhile, white-glove carriers can execute origin consolidation more efficiently, and because there are fewer handoffs, there is a smaller risk of delivery exceptions such as delays or damages.

Here, you can see that OnTrac’s average transit times were significantly faster than its counterparts in the same lane (California to Nevada). This data was pulled from Convey’s Carrier Performance Analytics function.

Brands like Bodybuilding.com are using regional carriers for zone skipping purposes, working with their regional carrier partners to build full truckloads to reduce transit days and costs. When the truckloads reach their designated region, or zone, they are assigned to an edge network, which can provide fast fulfillment that can meet customer expectations.

To fill in the communication gaps between hand-offs, Bodybuilding uses Delivery Experience Management to track shipments, detect issues, alert customers about exceptions, and resolve issues before they impact customers. This tactic reduced their WISMO calls by 27%, saving their team time and money. As an added bonus, their customers were happier as well — their NPS scores rose 6.3%.

Protect Your Team From The Dangers Of Single Sourcing

While Supply Chain and Logistics Managers know that single sourcing is dangerous, it’s even more dangerous in today’s fluctuating last mile market. This is a market that has gone from record high capacity a year ago to carriers, such as Schneider, shuttering their last mile services. Single events such as business closures, strikes, or Amazon Prime Days can drastically affect the experiences your customers receive.

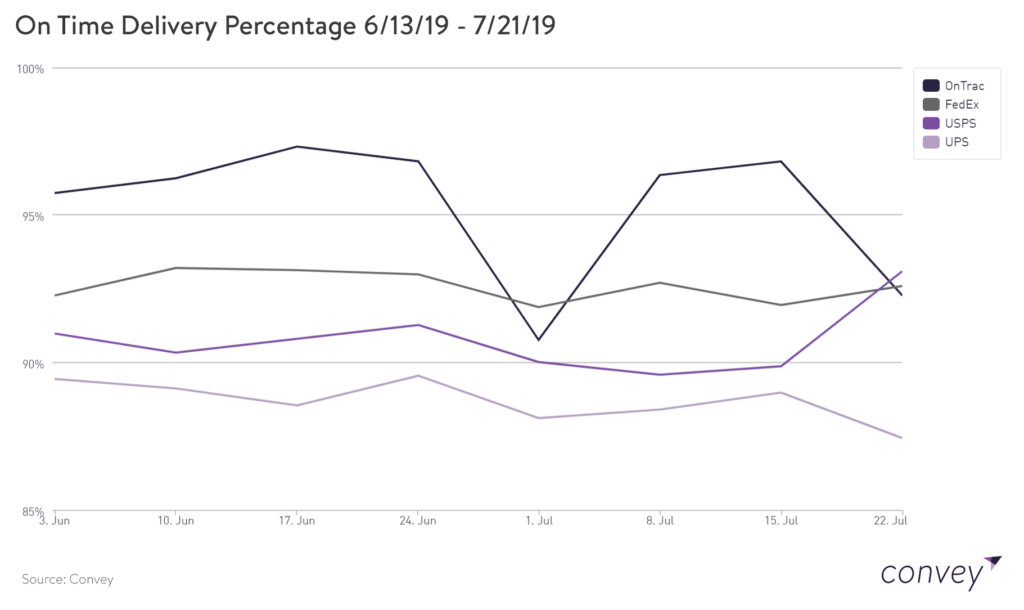

Diversifying your carrier mix can protect your business from these fluctuations. For example, during Amazon Prime Days (July 15-16), carrier capacity dwindled as delivery volume soared for Amazon, Walmart, and many other online players who used the days to boost their own sales. Despite strained capacity, regional carriers still had better service KPIs than their national counterparts.

As an example, the chart below shows the same lane (California to Nevada). During Prime Days and major summer sales, the regional carrier had a significantly higher On-Time Delivery percentage, relative to its counterparts.

Deciding On A Network Design Fit For Your Team

While complex networks may seem intimidating, they don’t have to be. With the right tools in place, fulfilling network design needs can be made more simple by thinking small(er) when thinking about which carrier relationships to cultivate. Once you collect information from your team, it’s critical to reach out to carriers and align on your transportation needs.

Here’s how to get started on your logistics network optimization:

- Do the research: First, research your shipping volumes to determine your volumes, chop up your lane data, and knock out your low hanging fruit. According to CH Robinson, many companies have roughly 80% of their load volume in 20% of their lanes, and likewise, 20% of their loads in 80% of their lanes. Logistics teams can start attacking low hanging fruit by addressing the 20% in higher demand lanes, and cost/capacity spikes in high volume lanes.

- Evaluate and test: Once you create your short-list of low hanging fruit for each geographic region, A/B test with different carriers, measuring them on benchmarks such as transit time, delivery exception rate, amount of positive or negative feedback, NPS, and cost.

Above all, remember: You are not locked into using a particular carrier, so make adjustments and improvements if they are necessary. Carriers are your partners, and will work with you to create a customer experience that’s beneficial to your budget and your customers’ needs.