June 17, 2021, Chicago, IL — Blank sailing data tracked at major Shenzhen ports by project44 has shot up, spelling further cost increases and inventory shortages for businesses as they struggle to meet the demands of reopening economies. The Port of Yantian (YICT), a critical connection for factories and retailers across the globe, which handles 13 million TEUs per year, is at the epicenter of China’s latest COVID-19 quarantine efforts.

Over the period of June 1 to June 15, 298 container vessels with a combined total capacity of over three million TEUs skipped the port a 300-percent increase in blank sailings in one month. Though the total capacity was not meant for YICT, the volume of loaded export containers that were left behind has caused a severe backlog and is due to create major delays and disruptions in global supply chains shortly after the Suez Canal incident.

The number of scheduled blank sailings announced by major carriers remains elevated through June 24, before falling off somewhat —assuming Chinese authorities are able to contain the virus, and allow ocean-freight carriers to return to normal operations. Even in this best-case scenario, it could take weeks to process backlogged containers, and shippers should expect serious delays.

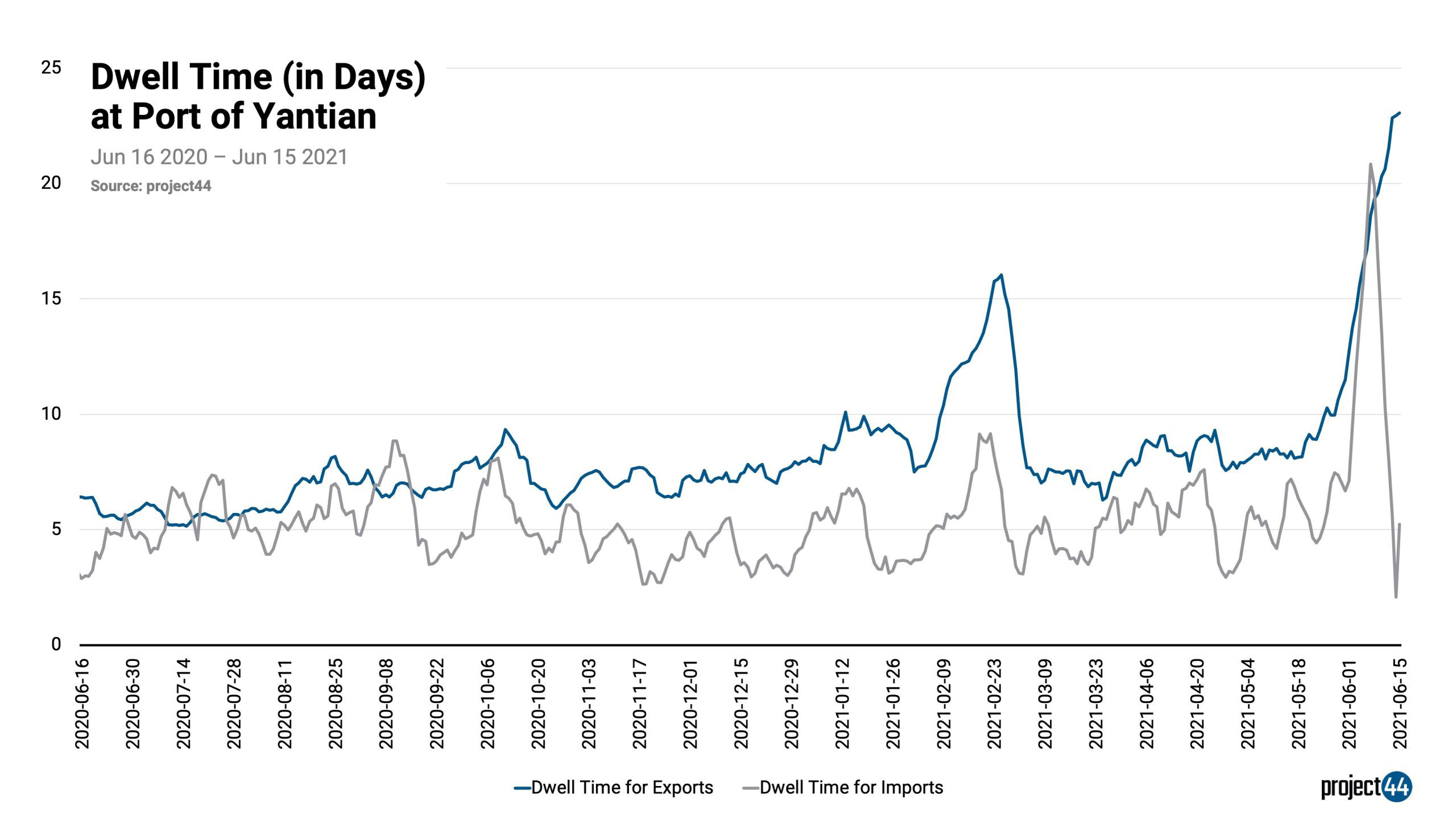

Dwell times at YICT also paint a grim picture. Over the last two weeks, the 7-day average of median dwell times on export containers from the Yantian terminal doubled in number, reaching 23.06 days on June 15, 2021. The mean dwell times on import containers into Yantian were lower, at 5.96 days for the same period, suggesting that carriers are avoiding the port. Between the dates of June 1 and June 15, the average dwell time for POL was 18.61 days, up 127.5% over the same time period a month earlier.

In the event that Chinese authorities extend their strict containment measures, high double-digit daily blank sailing rates could extend into July, snarling supply chains that use this critical global port well into the Summer.

Container lines such as Maersk have sent out client advisories that port capacity remains at less than half, with 19 of Maersk’s mainline services impacted, and that blank sailings were on track to get worse.

For businesses already facing inventory shortages, and unprecedented transportation costs, the numbers coming out of YICT will further complicate the process of reopening.

“While the epicenter of this particular breakdown is YICT, these numbers spell trouble across the maritime shipping world, and particularly for companies that rely on these routes,” said Josh Brazil, Vice President of Marketing at project44. “Even shipments not directly impacted by the Yantian situation could feel the impact, as carriers adjust their networks to avoid congestion at YICT.”

“We’re advising shippers with a China focus to get full visibility into your shipments, look for alternative ports, and do everything you can to get ahead of this event because it has the potential to create massive headaches across the global economy,” Brazil said.

Disclaimer: The data referenced in this release is sourced from project44’s freight visibility platform, based on the logistics indicators that the platform tracks. The sample data sets referenced do not include all freight movement data tracked by other entities. Data from project44’s platform reflects a statically significant sample size to draw conclusions.