Last Update: October 1, 2024

Summary:

- Unable to reach a new agreement for a labor contract, the 45,000 dockworkers of the International Longshoremen’s Association (ILA) began striking along ports on the East and Gulf Coasts.

- This strike will effectively shut down 36 ports that make up around 50% of all imports and exports in the United States during ocean peak season while retailers are importing goods for the upcoming holiday season.

- More than 100 vessels are estimated to arrive at these ports this week, so impacts will start immediately.

- All industries will be impacted by the strike, but some of the most impacted will include energy, petrochemicals, agriculture, manufacturing and machinery, automotive, retail and consumer goods, pharmaceuticals, chemicals, food and beverage, and construction materials.

- Some shippers estimate that for every one week of an ILA strike, it will take 4-6 weeks to fully recover and could cost the economy up to $5 billion per day.

Overview

The International Longshoremen’s Association (ILA), the union representing port workers at 36 ports on the East and Gulf Coasts of the U.S., was threatening to strike due to unresolved issues regarding their new contract. The current contract expired on September 30, with the strike starting at 12:01 on October 1. The key points of contention between the ILA and port operators include wages, benefits, and port automation.

Expected Impact on Ports

The impact of a strike of this scale to ports will be immediate and widespread. When labor ceases, freight currently at the port will be stuck and vessels scheduled to enter or exit the port will be impacted, causing ripple effects to vessel schedules globally. Vessels will likely have to anchor near ports as they wait, and import and export dwell will skyrocket. There are currently over 100 container vessels scheduled to reach these ports within the next week.

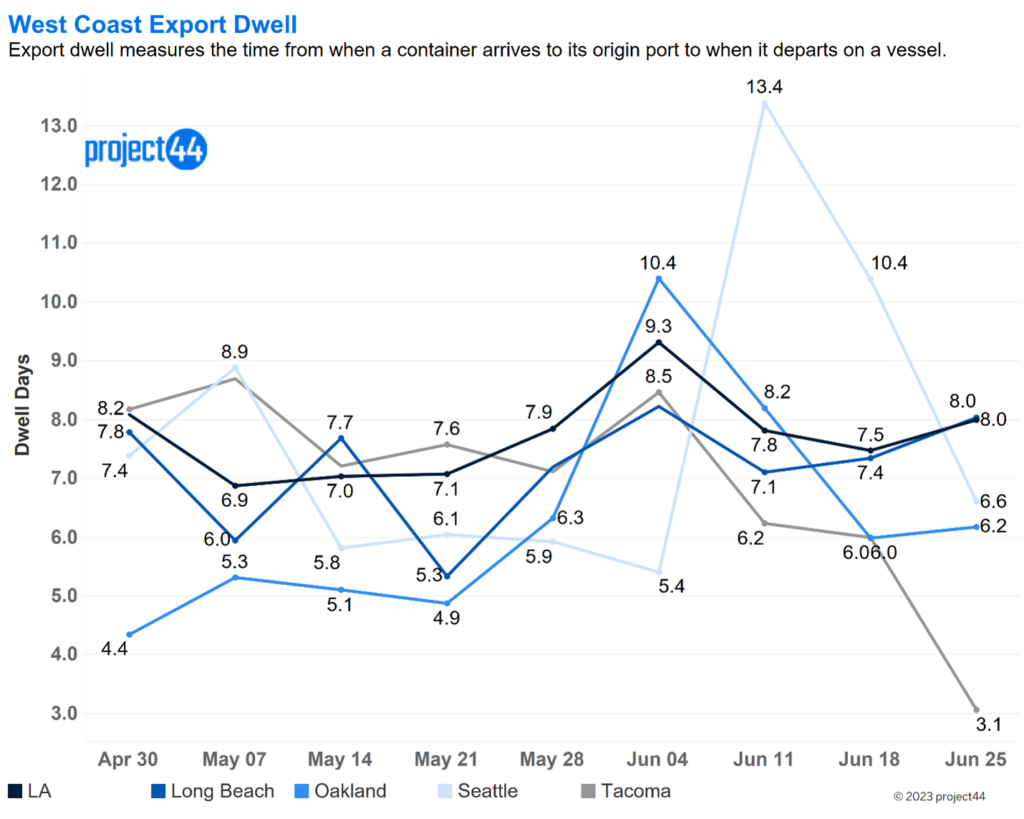

In 2023, the labor union on the West Coast staged a one day no show. After that one day, ports took three weeks to return to normal and work through the backlog of containers, and we saw as much as a 148% increase to dwell times, illustrated in the chart below.

Impacts to this strike will be longer lasting and more severe than the one-day strike back in 2023, particularly due to the timing. Peak season means that more freight is inbound, and the containers will continue to pile up until a new contract is enacted.

Impacted Industries

No industry is immune to the impacts of this strike, but there are some industries that rely more heavily on the East and Gulf Coasts than others.

Energy and Petrochemicals:

Gulf Coast ports, especially Houston and New Orleans, handle 60-70% of the U.S. exports of crude oil, refined petroleum products, and natural gas.

A significant portion of the petrochemical supply chain, including plastics and chemical feedstocks, also moves through these ports.

Agriculture:

About 60% of U.S. grain and soybean exports flow through Gulf Coast ports, with New Orleans being a major hub for agriculture exports from the Midwest.

Heavy Manufacturing & Machinery:

Gulf Coast ports handle around 25-30% of U.S. exports of industrial machinery and heavy equipment, much of it bound for Latin America and Europe.

Retail and Consumer Goods:

East Coast ports manage 35-40% of U.S. consumer goods imports such as electronics, clothing, and furniture. Ports like New York/New Jersey and Savannah are critical for trade with Europe and Asia.

Many of these imports are destined for the East Coast and Midwest retail markets.

Automotive Industry:

Approximately 30-35% of U.S. automotive imports and exports pass through East Coast ports, especially vehicles and parts from Europe. The Port of Baltimore is a key hub for RoRo (Roll-on/Roll-off) vessels. When the port temporarily halted operations, the industry remained stable by rerouting shipments to nearby ports. However, if a strike occurs in October, disruptions to manufacturing will likely be unavoidable.

Pharmaceuticals and Chemicals:

Approximately 30-35% of U.S. pharmaceutical imports flow through East Coast ports. This includes active pharmaceutical ingredients (APIs) and finished drugs from Europe, India, and other regions.

Food and Beverages:

East Coast ports manage 30-40% of U.S. food and beverage imports, including perishables like produce, seafood, and processed foods from Europe and Africa.

Construction Materials:

Combined, the East and Gulf Coast ports handle about 25-30% of U.S. imports of steel, cement, and other construction materials, primarily sourced from Europe and Latin America.

Impacts to Peak Season

The timing of the strike is critical, as it occurs during the ocean peak season (August through October), when retailers are importing goods for the upcoming holiday shopping period. Since East Coast ports handle 35-40% of U.S. consumer goods imports, and it is too late for companies to divert peak season volumes to the West Coast, this strike is likely to have significant impact on retailers’ ability to stock inventory in time for the holidays depending on how long it lasts.

There is also a heavy seasonal component to a lot of imports. Goods such as holiday decorations are only in demand prior to the holidays. If these goods are stuck at ports during the period that they would normally sell, retailers will have to either sell at heavy discounts when they arrive, try to work out returns to vendors, or store the goods for a year until they are seasonally relevant again. All of these options cut into the profit margins of retailers and could result in higher prices for consumers.

Some retailers may turn to air freight as an alternative, this market is both constrained and substantially more expensive, making it an impractical solution for large-scale imports.

Truckload, Rail, and Air Impacts

While the strike is only taking place at ports, this will have ripple effects for other modes of transportation. Shippers may opt to bring freight into the West Coast rather than East Coast, which will increase demand for rail and truckload transportation for freight to cross the country. This will likely cause increases in rates, as well as congestion and higher transit times for freight, as well as difficulty securing capacity.

Air freight is another option for shippers. This reduces transit time, which may be critical given the quickly approaching holiday season, but that comes at a cost. Air freight is the most expensive mode of transportation and also is able to carry the least capacity. There is heavy competition for space on planes as well, particularly out of China with companies like Temu and Shein leveraging much of the capacity.

Overall Economic Impacts

Inflation has been a hot topic since the pandemic. The feds have recently cut interest rates for the first time in years, signaling that they feel as though inflation has finally gotten under control. With a strike of this scale, that progress could be rapidly undone. The strike is estimated to cost the economy $5 billion per day.

The strike can also lead to shortages in supply as well as increased transportation costs. Both of these things will likely result in higher costs to the end consumers, similar to what was seen on some goods during the Covid-19 pandemic when there were shortages of things like medical supplies and toilet paper.

Summary

The International Longshoremen’s Association (ILA), representing port workers at 36 East and Gulf Coast U.S. ports, is on strike as of October 1st due to unresolved issues in their contract negotiations, including wages, benefits, and port automation. The strike’s impact on ports will be severe, halting freight movement and disrupting global vessel schedules. Key industries like energy, agriculture, manufacturing, retail, automotive, pharmaceuticals, and construction will be heavily affected, potentially leading to supply shortages and increased costs for consumers. Occurring during peak shipping season, the strike threatens to disrupt holiday retail supply chains, compounding economic impacts estimated at upwards of $5 billion per day and risking inflationary pressures.