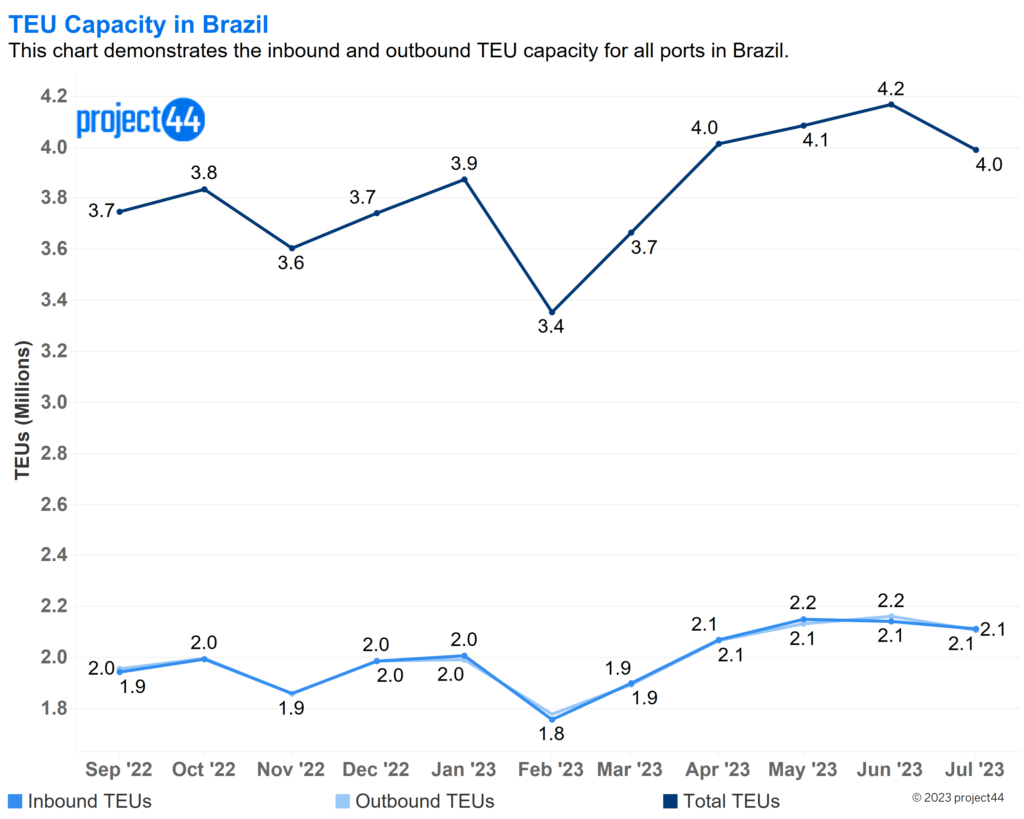

TEU Capacity In and Out of Brazil

According to project44 data, the total TEU capacity has exhibited stability, reflecting a minor decline of 200,000 TEUs in July. Notably, this decrease follows a consistent trend of elevated capacity over the last four months, consistently exceeding 4,000,000 TEUs. These figures underscore robust capacity associated with trade to and from Brazil, indicative of heightened trade activity.

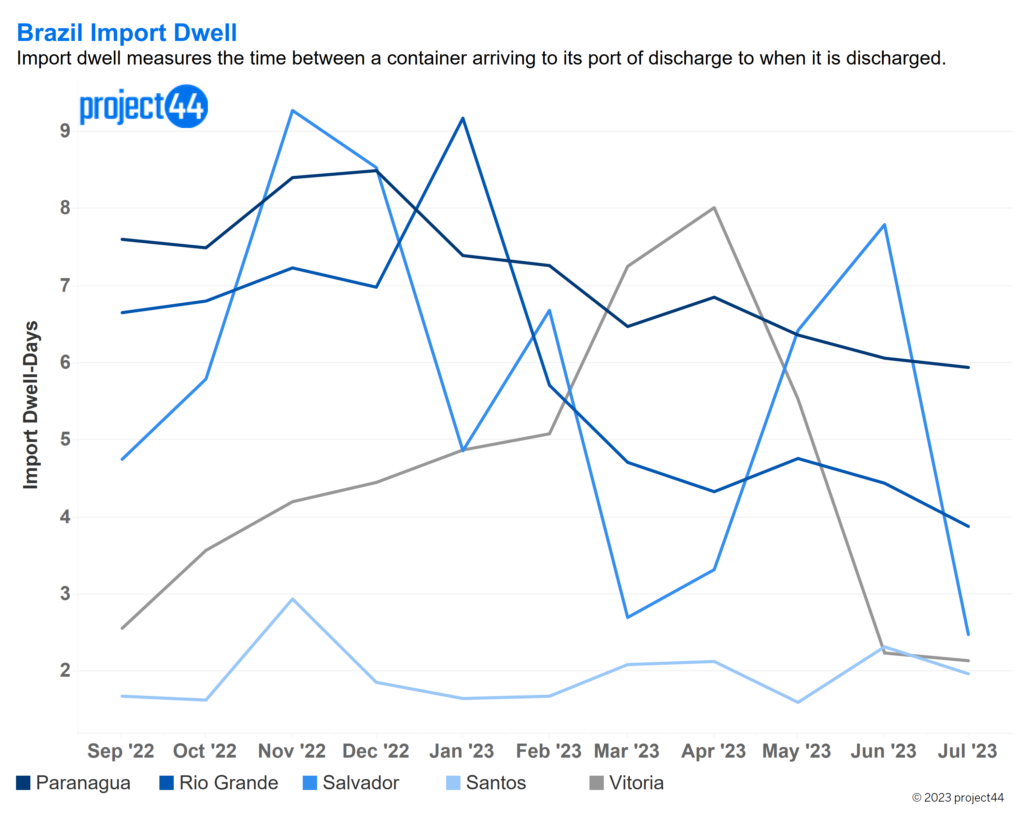

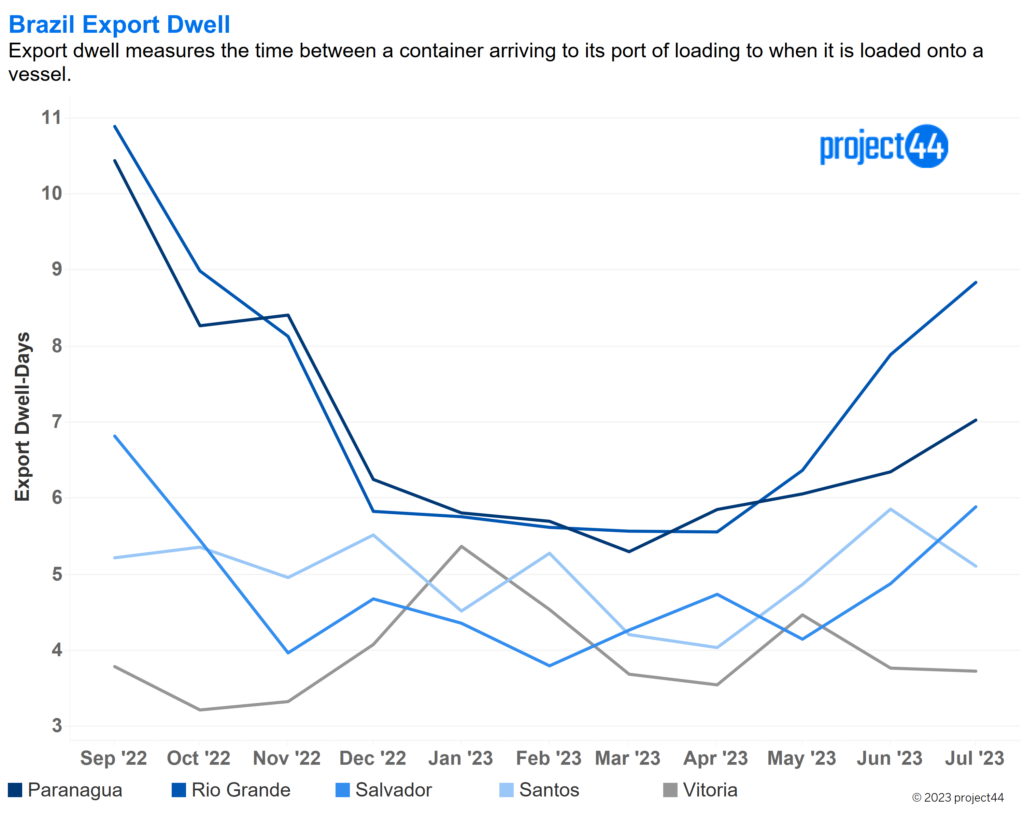

Import and Export Dwell by Port

The following charts show the median import and export times for major ports in Brazil.

Import dwell times in Brazil remain volatile, but have shown overall improvements, particularly for the month of July. In Vitoria, there has been a remarkable 75% reduction in dwell times over the past 3 months, reaching a recent low of 2.1 days. Salvador experienced a significant 71% decrease in dwell times between June and July. In July, the median dwell time stood at only 2.5 days, with a 28% drop in import volume contributing to this improvement. Both Rio Grande and Paranagua have maintained a consistent trend of decreasing import dwell times, even as import volumes remain high. In contrast, Santos has exhibited stability in both dwell times and import volume, showcasing a reliable performance in these aspects.

Export dwell times in Brazil have exhibited varying trends across key ports. Paranagua, Rio Grande, and Salvador have all experienced increases in dwell times since July. Paranagua’s dwell time increased by 9%, Rio Grande’s by 11%, and Salvador’s by 20%. These increments could be attributed to several factors influencing port operations. Notably, Rio Grande’s volume has surged by over 100% since May, potentially contributing to the challenge of managing increased operations efficiently. Conversely, Vitoria and Santos recorded slight reductions in dwell times in July. Vitoria’s dwell time decreased by 2.5%, while Santos saw a more significant 13% decrease. As volume remained stable at these two ports, these modest decreases suggest positive operational management despite the broader trend of increased dwell times in other ports.

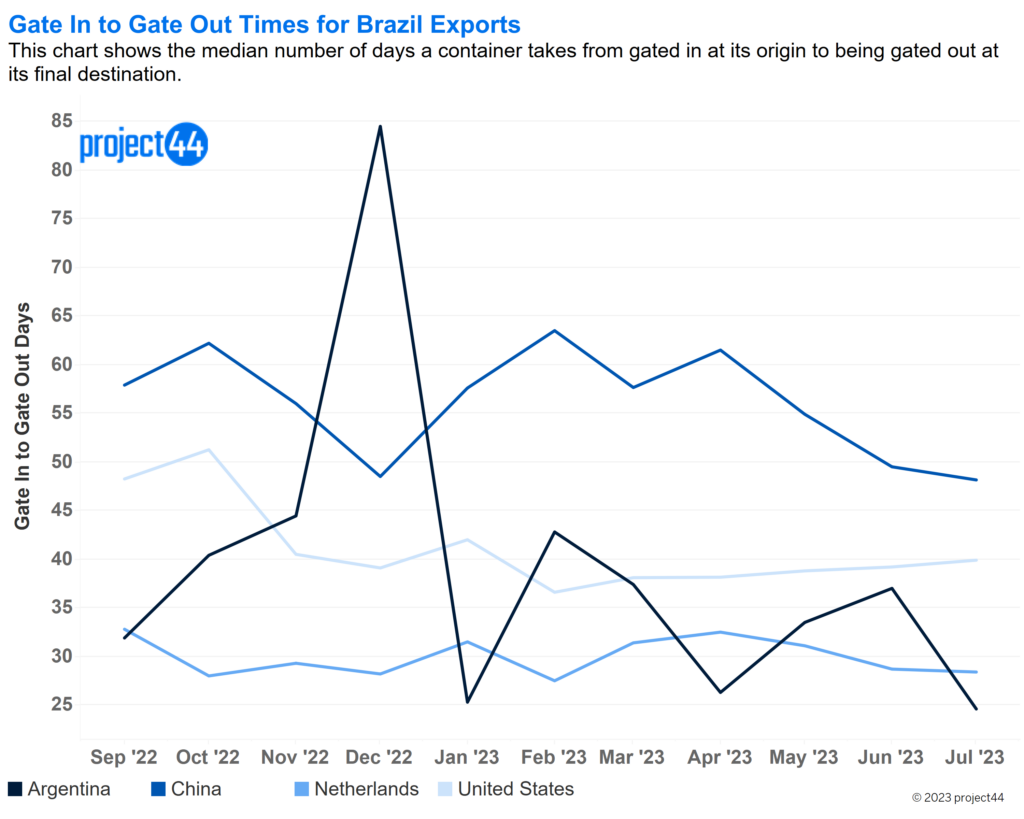

Container Lead Times for Imports and Exports

The subsequent charts illustrate the median lead time for imports and exports of Brazil to major trading partners. This indicates whether there are significant operational challenges or weather-related obstacles along major trade routes.

Lead time has remained stable for imports, showing that ports are operating smoothly and there are no major bottlenecks at this point impacting imports coming into Brazil. With the exception of a minor uptick in lead time to India, all lanes saw mild improvement compared to June.

Export lead time has also remained mostly stable. While Argentina has been unstable throughout the year, there was a 32% improvement between June and July, and July is 2 months lower than the peak lead time of 85 days seen in December.

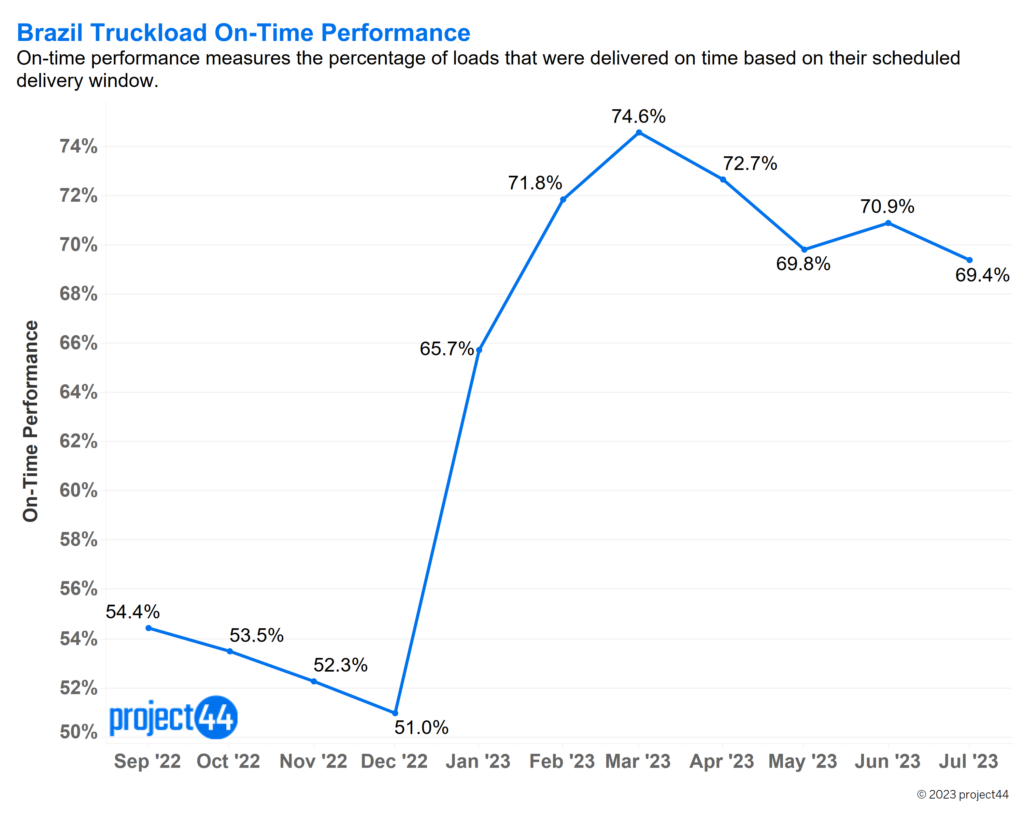

Truckload On-Time Performance

Full truckload on-time performance continues to hover right around the 70% mark. This is an astounding improvement when compared to the 51% on-time performance seen in December 2022. Despite the overall improvement, July is trending 1.5% lower than June and a full 5.2% when compared to March’s rate of 74.6%.

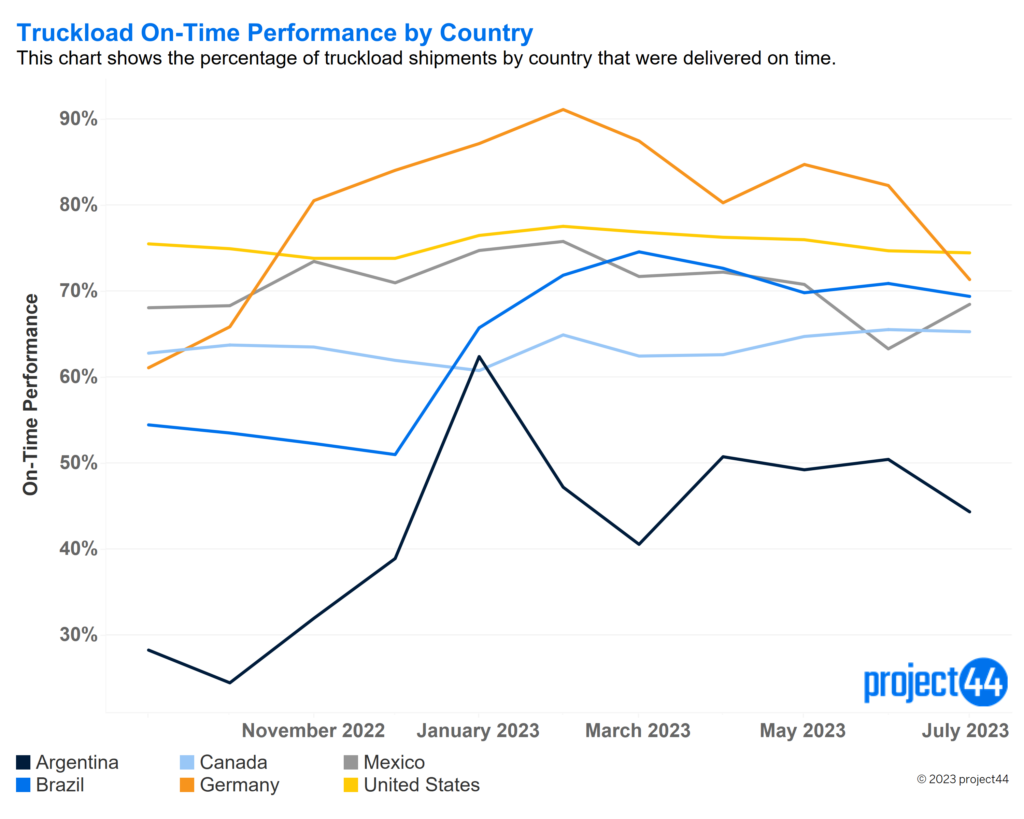

When compared to other countries, Brazil falls in the middle of the pack, outpacing Canada and Mexico in July and trending a full 25% higher than Argentina, but still lagging behind the US and Germany.

For questions or comments:

press@project44.com

Disclaimer: The information conveyed herein, shared solely for summary and not contractual purposes, comes from both project44 and third-party reporting. The project44 data does not include all available market information, and project44 has not undertaken to independently verify the third-party reporting. Similarly, this type of data changes from day-to-day. Accordingly, the reader should not rely on this reporting to make any business decisions, and project44 expressly disavows any liability arising from any such reliance.