Executive Summary

- On-Time Performance has decreased by 1% compared to last month

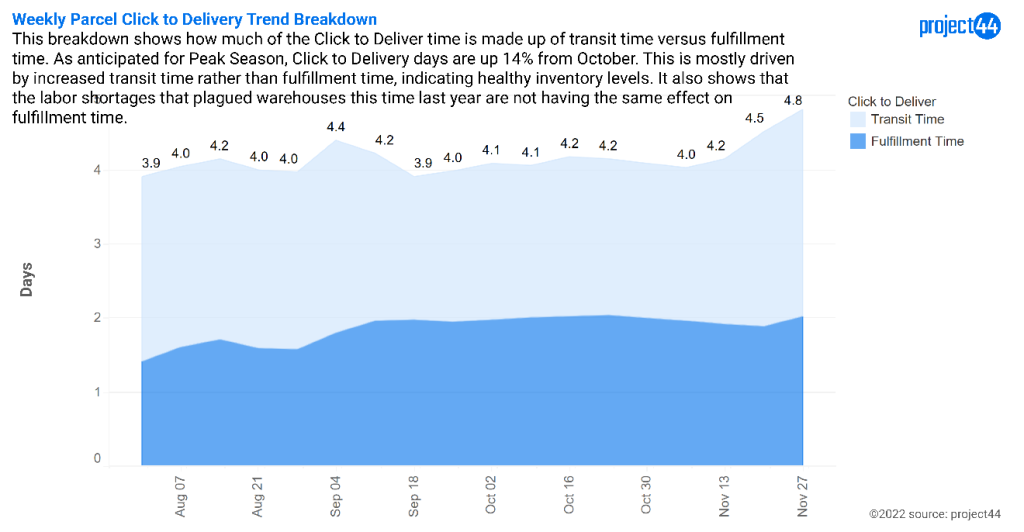

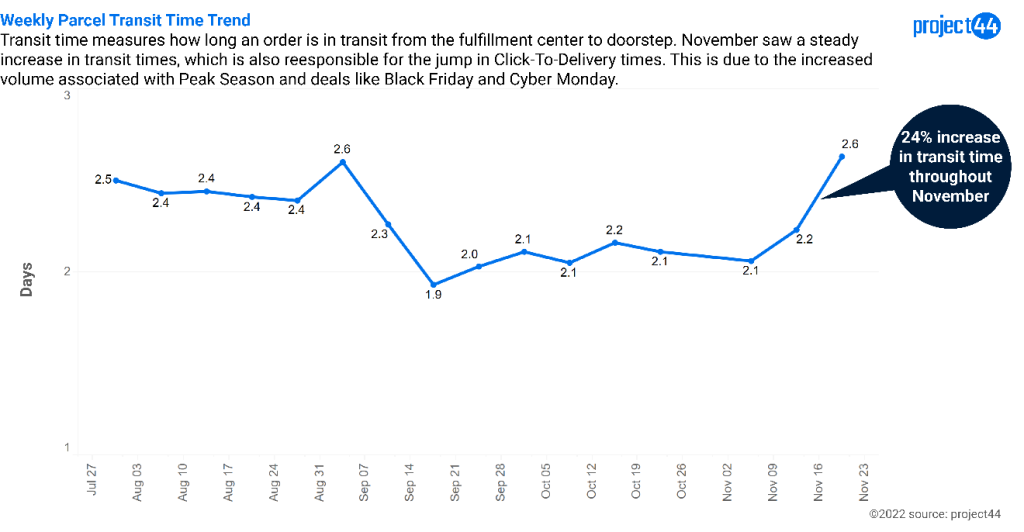

- Click-to-Delivery Time has increased as expected for peak season. This is mostly driven by increasing transit times

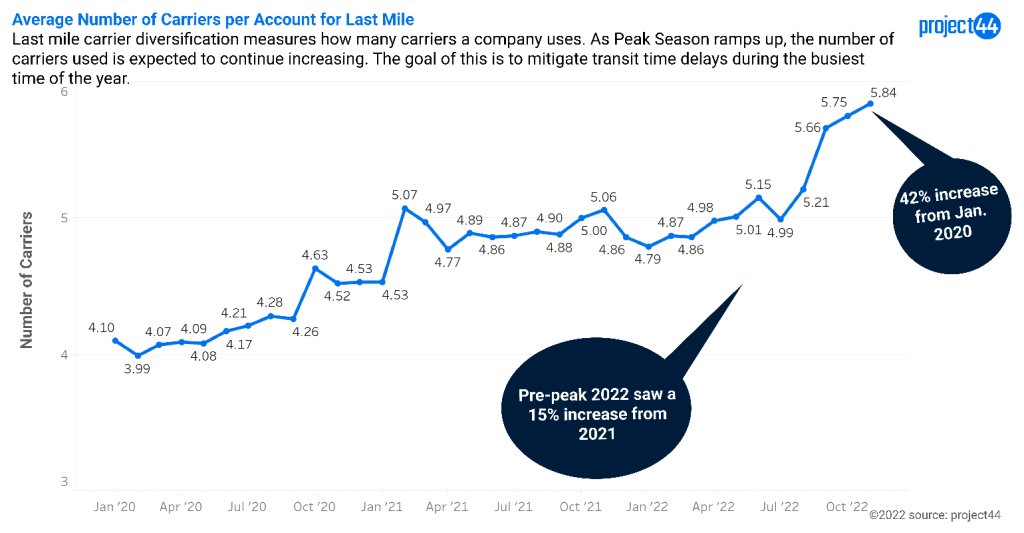

- Carrier diversification is continuing to increase

Last mile deliveries make up some 53% of the total shipping cost and 41% of supply chain costs according to Accenture. As a vital component of supply chain management, last–mile delivery plays a crucial role in ensuring consumer satisfaction, but it is also expensive, and mistakes can be costly if not planned properly.

Peak Season

As the holiday season rolls around, there is an annual spike in last mile shipping across the United States. November marks the beginning of peak season for the last mile market as end consumers begin their holiday shopping and it extends through January.

The last mile leg of the supply chain is the most heavily impacted by peak season demand and is also facing persistent labor shortage issues, so on-time performance is unlikely to recover to 2019 levels of 90% anytime soon. Initiatives taken by retailers to mitigate these impacts include extending sales so they are not focused on specific days and increasing their pool of carriers to ensure the increased volumes can be handled. Despite the steps taken, delays are still prevalent.

On-Time performance was lower in October 2022 than it has historically been prior to peak, however we only saw a .4% decrease going into November so this does not seem to have a heavy impact on On-Time Performance during peak season. On-Time Performance is expected to further drop in December as in past years, but should start to recover in January 2023 after the holidays.

Click to Delivery Time

A key measure for e-commerce customers is the click to delivery time, which measures the amount of time between when the customer hits the buy button and when the item is delivered. This consists of both fulfillment time (the time it takes for a warehouse to pick, pack, and ship the order) and transit time (the amount of time the order takes to ship from warehouse to doorstep).

The month of November has seen an expected 20% increase in click to delivery time, predominately driven by transit times. The marginal increase in fulfillment times is a combination of retailers having healthy (or over-saturated) inventory on hand in tandem with decreased holiday spending due to high inflation rates and a questionable economic outlook.

A closer look at transit times shows a 24% increase through the month of November. While retailers have worked to mitigate the risk of transit delays by increasing their carrier diversity, there are still labor shortages and delays associated with peak season.

Carrier Diversification

Carrier diversification refers to how many different carriers a company uses on average. While it can be difficult for companies to manage numerous relationships and contracts, it allows them to have a more flexible supply chain when it comes to Last Mile. If a certain carrier is at capacity and a company still has orders that need to be shipped, carrier diversification allows the companies to choose from a portfolio of different shippers.

Covid-19 caused an unprecedented spike in online sales that prompted this shift as companies were not able to keep up. There has been a 42% increase in the average number of carriers since January 2020, and that trend is continuing to increase consistently with a 1.6% increase from October 2022 to November 2022.

Outlook

Last mile peak season delays have begun, particularly driven by increased transit times. Delays are expected to increase during December with the increase in holiday shopping and will recover starting in January. Initiatives taken by retailers to smooth demand and increase carrier diversification should mitigate effects on customers, but to err on the side of caution, it’s best to avoid last minute shopping.