Apparel is a prominent industry with the U.S. apparel market hitting $341.6 billion in revenue in 2018. While this number is expected to grow in the coming years, apparel companies have faced various shifts over the last couple of years, causing them to rethink their supply chains.

Like the rest of the world, the industry is adjusting plans to mitigate disruption from the COVID-19 pandemic, taking it day by day. And in addition to the pandemic, the apparel industry has been going through an evolution due to effects from tariffs, a focus on environmental sustainability, and evolving consumer expectations.

To learn more about recent changes in the apparel market and how the pandemic is impacting apparel manufacturing, project44 VP of Business Development John Fitzgerald sat down with Kurt Cavano, Founder of GT Nexus. Kurt Cavano shared his insight into challenges in the apparel industry, why the supply chain is so complex, and how forward-thinking supply chains are evolving.

John Fitzgerald: What are some of the challenges apparel supply chains are facing today in addition to COVID-19?

Kurt Cavano: The challenge with the apparel supply chain is that the supply chains of most of the companies in the apparel space have been in flux for the last several years. It started well before the virus when China began to shift a lot of production from being oriented towards export to being oriented toward Chinese consumption. When that happened, a lot of apparel manufacturing began to move out of China into places like Vietnam and Bangladesh.

On top of that, brands and retailers have had to deal with the new tariffs on goods coming from China. And then COVID-19 came along on top of that. All of this has created a tremendous amount of turmoil in the apparel supply chain. It’s this constant flux that supply chain managers deal with that is causing companies to really think differently about their supply chain. The virus is the latest of a number of shocks that have occurred in the apparel supply chain.

Fitzgerald: What factors or complexities make it so difficult for apparel supply chains to react to these challenges?

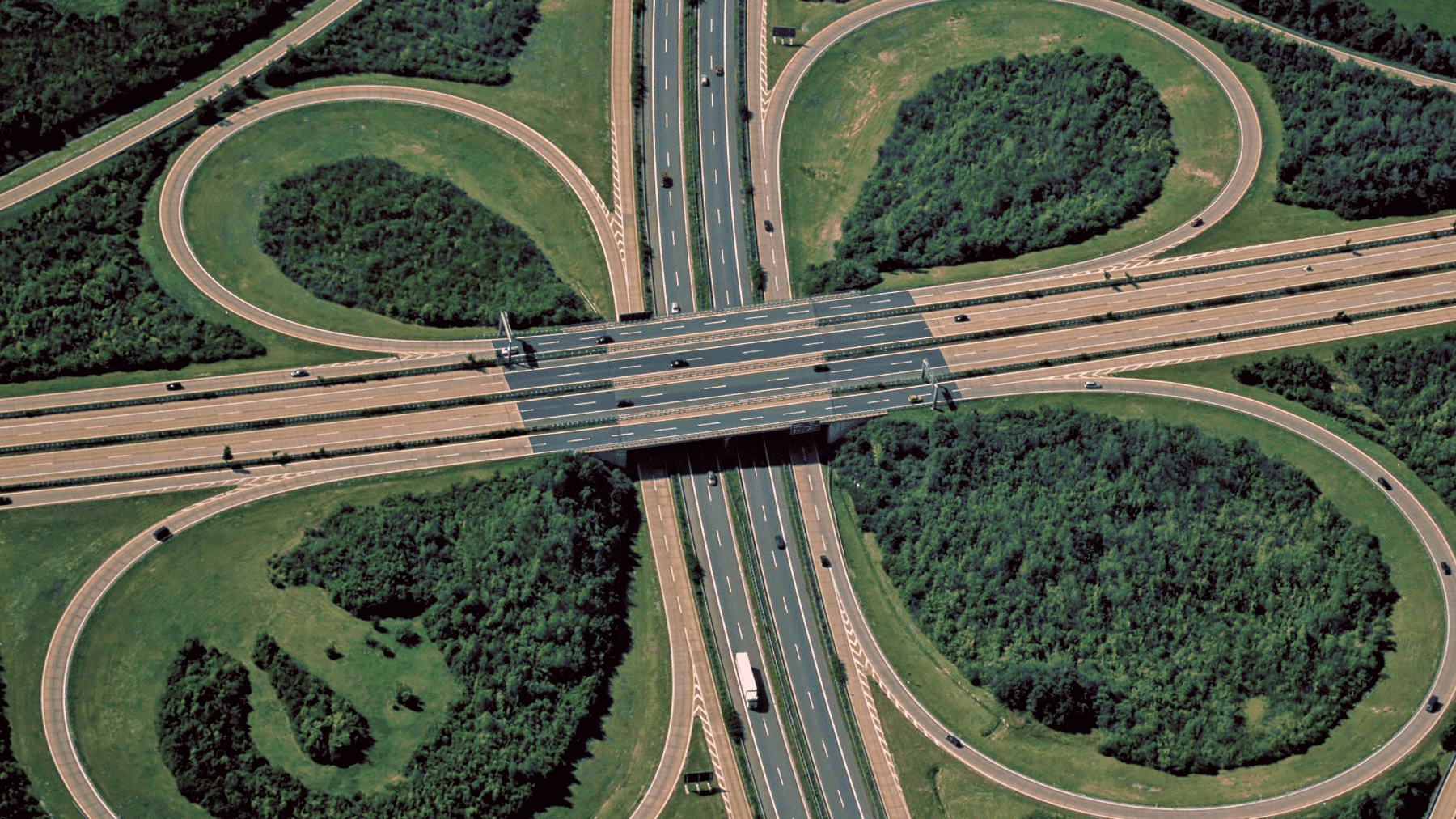

Cavano: Like a lot of other manufactured goods, apparel requires a combination of raw materials that need to come together. A lot of manufacturing has built up over time in clusters where you have factories producing fabric, yarn suppliers, and trim suppliers all in the same area. There’s actually a city in China that focuses just on socks.

Because of this, moving manufacturing to another location is not that simple. Over the years apparel has moved from country to country, but it’s moved rather slowly because of the need to have everything as close as possible. One of the things that’s coming out of the COVID-19 situation, as well as the tariffs, is that people are rethinking their whole supply chain and asking themselves if they should move closer to the United States.

In some ways this forced change is good. The old model that’s been used in apparel forever is that you send orders to the other side of the planet and 120 – 180 days later, a container load of stuff shows up and you put it on the shelves. If it sells, great. If it doesn’t sell, sometimes it’s discounted, sometimes you sell it off to discounters, or in some sad cases, they actually burn the goods.

This model of apparel sourcing is broken. I think the apparel supply chain is going to get reinvented by forward-looking companies that are starting to ask: How do I get closer to the United States? How do I shorten lead times? How do I think about smaller batches instead of buying container loads of stuff and hope it sells? It’s environmentally more sensitive with less waste and it’s closer, so there’s less transportation.

Fitzgerald: You bring up the environmental impact, which has been a growing concern for supply chains in recent years. What role do you believe environmental sustainability will play as companies rethink their supply chains?

Cavano: This whole environmental sustainability movement has really woken up. When you combine that with the shift that’s already taking place, I think it’s going to make for a radical rethink of how we do manufacturing. Bringing it much closer to the United States, manufacturing for smaller groups of people with smaller runs.

I think that in an odd way, this virus and its effect on supply chains is going to bring environmental concerns to the surface and cause people to rethink the way we do everything. We have to rethink our whole consumption methodology, which will pour right into how we manufacture things.

The new company that I’m working with right now is a startup called Nimbly Made. They’re doing on-demand knitted goods manufacturing in the United States. Our thesis is that people would rather wait a few days and get something that’s made particularly for them. It’s more expensive, but we’re finding that people are willing to wait and get exactly what they want. They might pay a little more for it, but it’s made locally, and it has a low carbon footprint.

I can imagine a day where retailers have on their website, not just the delivery options, but the carbon footprint options. Where it says here are the three delivery options and here’s the carbon footprint of each, allowing the customer to choose. I think if we can get to that place, people are going to start picking a low carbon option.

Fitzgerald: While many supply chains will rethink their approach coming out of this disruption, what do you think they’ll do in the meantime to kind of mitigate some of the risks?

Cavano: I think in the meantime, people are going to keep doing what they’ve been doing, which is import from far away. I think what has already taken place at a lot of the smartest companies have built a diversified supply chain.

This means that they’re not just sourcing 80% of their goods in one country, unless it’s maybe local, but they’re sourcing it from a variety of different places. When I take a look at the more sophisticated companies supply chains, they’ve got 10 or 15 different countries that they’re sourcing from. They’ve got a backup for each of the major categories.

I think you’re going to see more people moving their stuff into a variety of places so that they can have, just as you would with stocks, a portfolio approach. You don’t have all your money in one place, you don’t have all of your manufacturing in one place.

Fitzgerald: Do you think COVID-19 is causing these apparel supply chain trends or accelerating them?

Cavano: I don’t see global trade going away, but I think companies are going to rethink their supply chain and ask how they can: 1) move to a more diverse portfolio of places; 2) move closer; and 3) shift to an on demand basis.

I think that people were already thinking this way. The sophisticated supply chains had become more diverse, they were moving a little bit closer. The tariffs accentuated that, but I think COVID is the last straw that will force them to figure this out. In the last five years, we’ve seen so much disruption in the supply chains that we need to figure out how to make supply chains more stable.

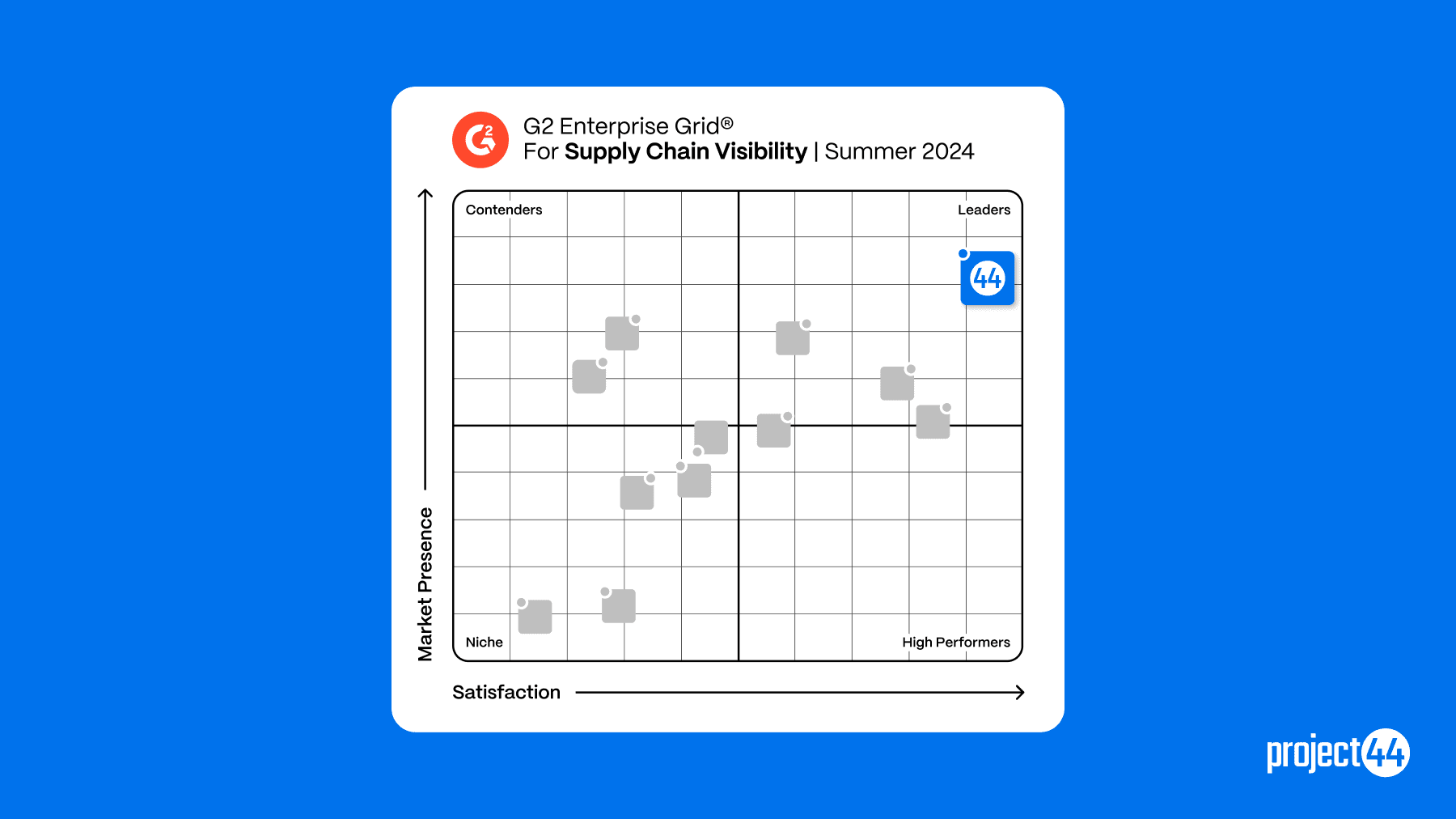

Stay updated on shipment trends as market conditions evolve due to the pandemic.

Powered by project44, gain insight into shipment volumes and dwell times.