September 21, 2023

Summary:

- Clusters of vessels continue to linger at either end of the Panama Canal awaiting passage.

- Passage time through the canal continues to increase across the board. Carriers are now bidding to get slots to pass through the canal, further increasing costs.

- Lead time for containers going from China to the US East Coast has increased 10% since the beginning of August.

Congestion in the Panama Canal Persists

Clusters of vessels remain queued at both ends of the canal. The map below displays the current container vessel traffic around the canal as of September 21, 2023.

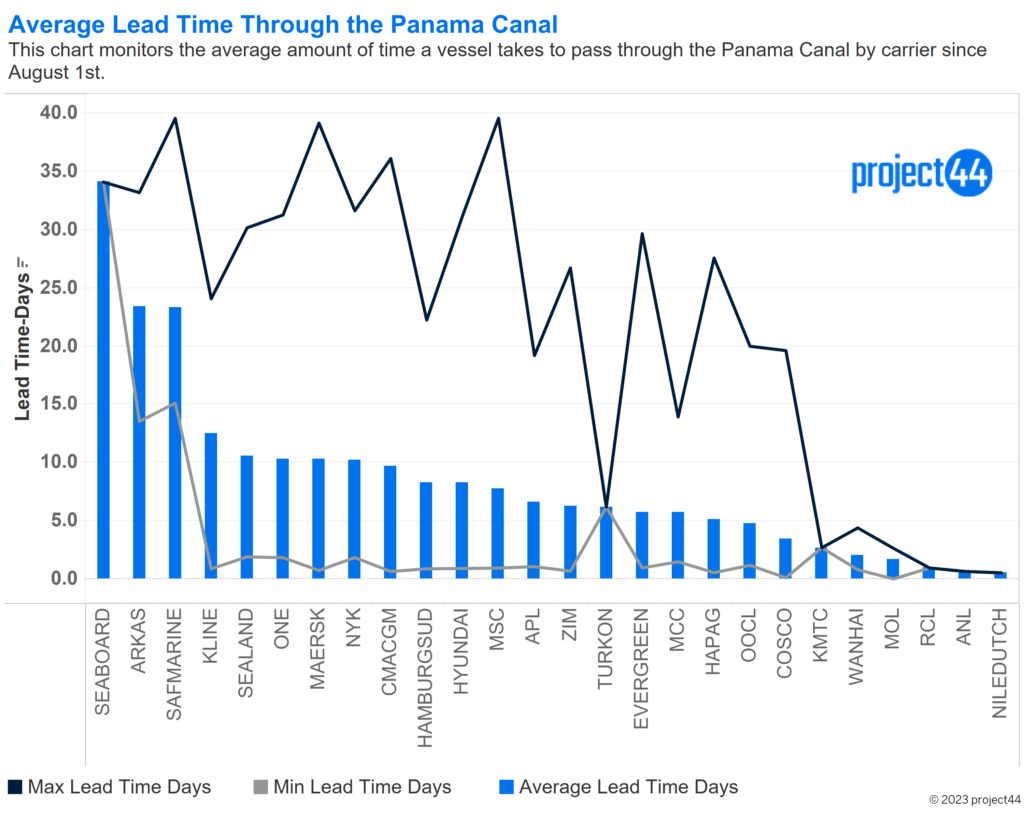

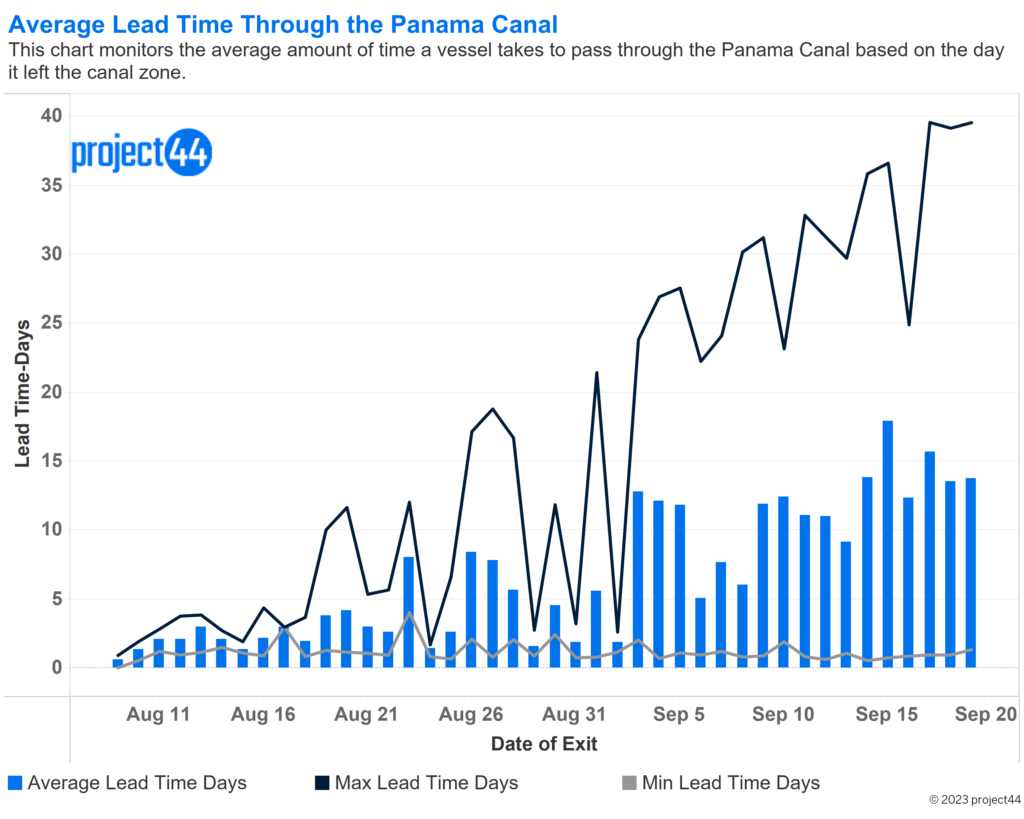

Lead Time Through the Canal

The chart below provides insights into the average time required for different carriers to traverse the canal, highlighting the varying impacts of these restrictions.

The Panama Canal Authority continues to stress the importance of booking vessels. However, there has been a clear increase in overall lead time due to the decreased daily throughput of vessels. This decrease has also led to a surge in demand, with some companies bidding millions of dollars for priority access to the limited slots. Lead times and congestion around the canal are not expected to ease in 2023, and these additional costs incurred by some carriers to expedite freight may lead to price increases as transportation costs rise for shippers.

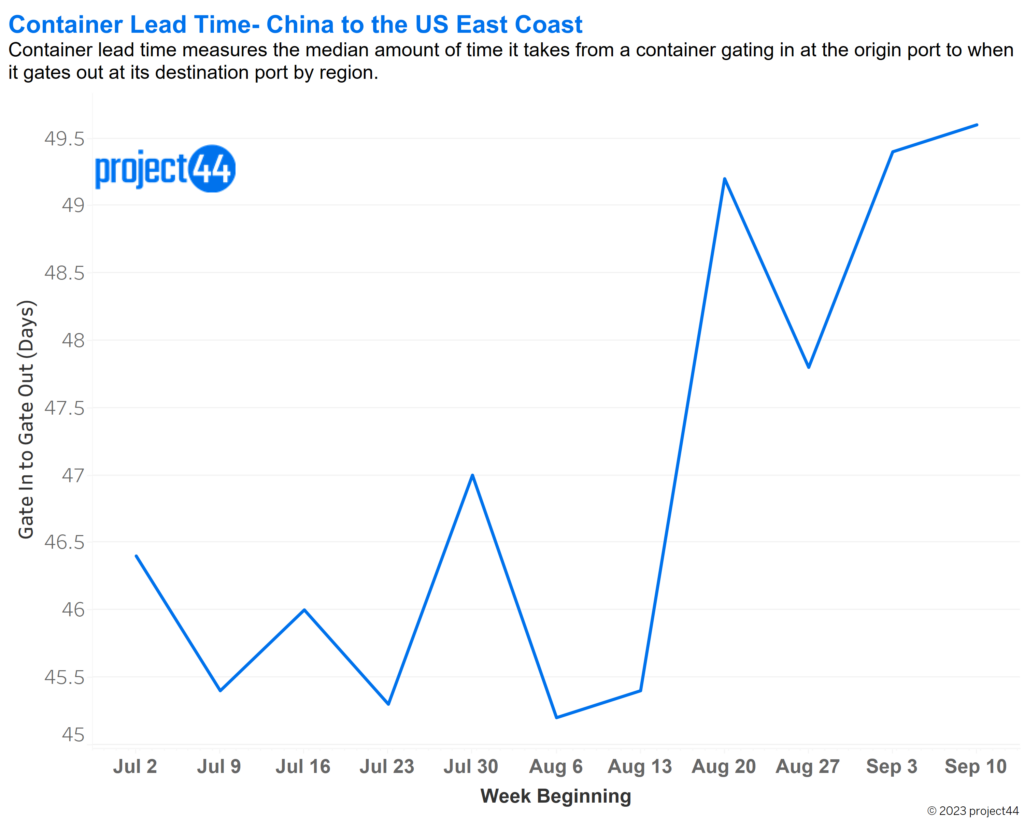

As lead times through the canal increase and containers begin to reach their final destinations, the overall container lead time for lanes utilizing the Panama Canal is on the rise. One of the most impacted routes is the China to the US East Coast lane, which has experienced a 10% increase in lead time since the beginning of August.

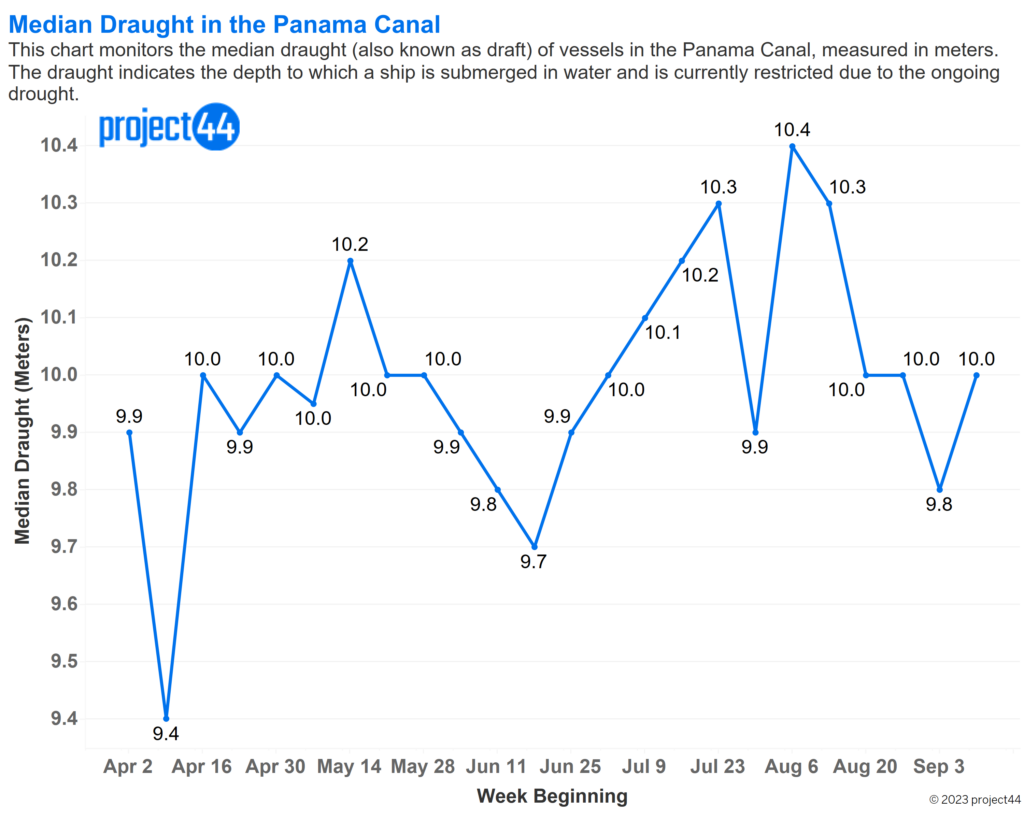

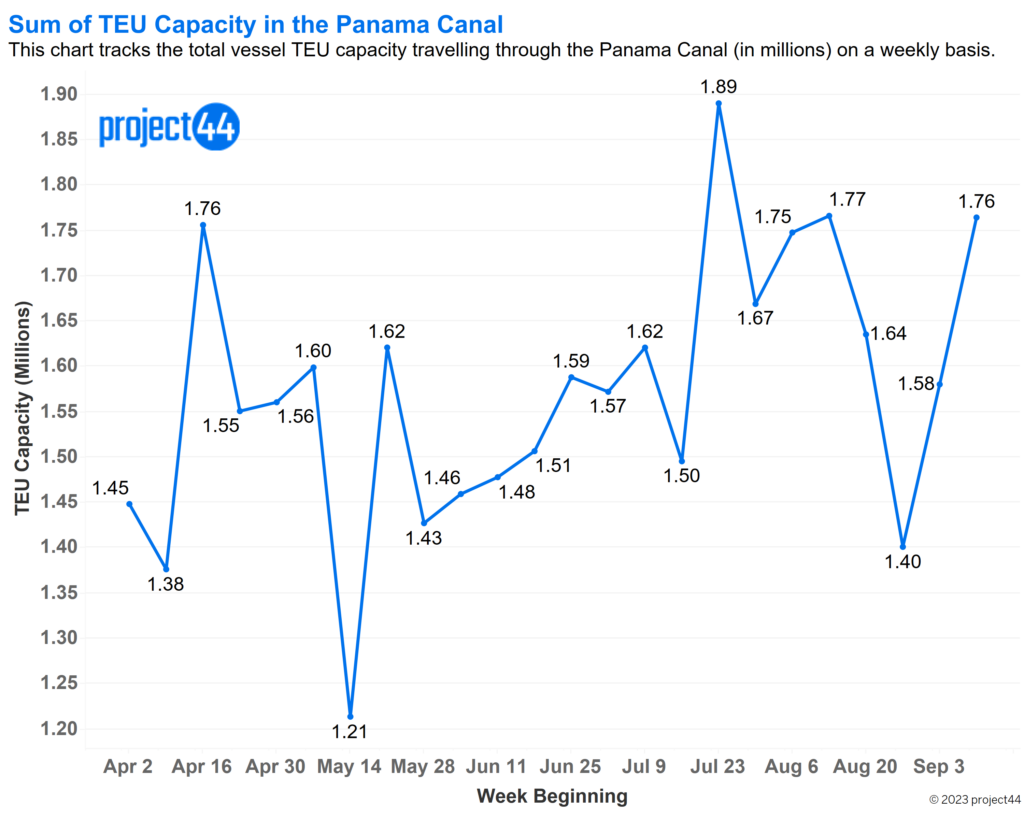

TEU Capacity and Draught Levels

The draught restrictions implemented do not seem to have a significant impact on the majority of vessels transiting the canal. While the median draught levels fluctuate, the overall trend has remained stable since the restrictions were put in place. It’s worth noting that draught restrictions can affect the largest vessels using the canal. In one instance, a vessel had to transfer some of its containers to a second vessel to meet the draught requirements for passage. However, overall, this hasn’t posed a significant bottleneck for canal traffic.

The total TEU (Twenty-Foot Equivalent Unit) capacity has remained remarkably stable, even with the restricted number of vessels able to transit the canal. This suggests that while fewer vessels are passing through, larger vessels are still able to maintain a consistent volume of cargo throughput.

Outlook

The restriction that has the most significant impact on shippers is the limit of 32 vessels for passage. Consequently, wait times for transiting the Panama Canal are on the rise across the board, and vessels are aggressively bidding to secure these coveted available slots. As costs increase to navigate the canal, it is expected that these expenses will eventually be passed on to shippers and, ultimately, end consumers. Lead times are also on the rise and are expected to continue increasing as heavy shipping volumes, gearing up for the holiday season, persist.

In the short term, there is the possibility of further restrictions due to the ongoing drought. It is expected that this situation may worsen before any improvements are seen.

For questions or comments:

press@project44.com

Disclaimer: The information conveyed herein, shared solely for summary and not contractual purposes, comes from both project44 and third-party reporting. The project44 data does not include all available market information, and project44 has not undertaken to independently verify the third-party reporting. Similarly, this type of data changes from day-to-day. Accordingly, the reader should not rely on this reporting to make any business decisions, and project44 expressly disavows any liability arising from any such reliance.